Editor’s Note: This article is part of a series Rethinking65 is doing on older advisors who are continuing to work. You may also be interested in reading our articles on Don Rembert and Dick Wendin (both 82), David Demming (74) and Minoti Rajput (70). Want to suggest an advisor for the series? Contact Editorial Director Jerilyn Klein.

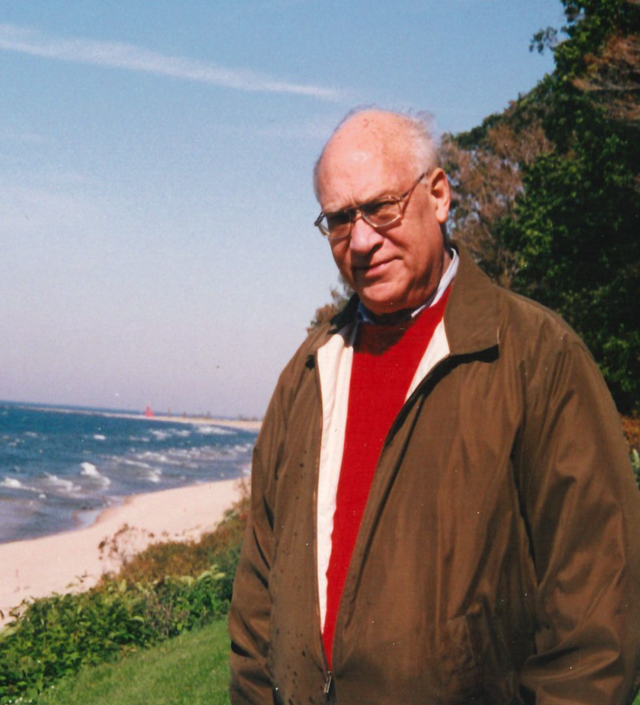

When asked if he ever considered retiring at a traditional age, Herschel V. Clanton, known as Vince, was unequivocal.

“No,” said the 72-year-old Atlanta, Ga. CFP and CLU who founded Chancellor Wealth Management, in 2002.

In his late forties, Clanton sold his shares in an Atlanta food brokerage business he had helped his father operate since 1972. After years of 60 hour-work weeks full of tension, a payroll of about 130 employees, and pressing responsibility, Clanton was a man of leisure.

But in the same year, 1995, he was contacted by a financial services recruiter and he made the transition from one career to another.

“Before I really got going in financial services, I became president of a healthcare third-party administrator for employer health plans. I did that for a little over two years and engineered a turnaround that got it back on solid ground. At that point, I hired someone who was a very capable replacement,’’ Clanton said from his Atlanta office.

By 2002, Clanton had found his new niche. That year, he earned his CFP but had to wait six weeks for the results of the two-day test, a common protocol in that era.

Clanton received his undergraduate degree in aerospace engineering from Georgia Institute of Technology, and his MBA from Georgia State University. He retired from the U.S. Navy Reserve with the rank of Commander after more than 20 years of service.

The Hardest Test

But he recalls that the CFP test was the most demanding test he had ever taken.

“I loved studying for the CFP because I had purpose. This gets to the heart of why I started Chancellor Group, which became Chancellor Wealth Management — we changed our name two years ago: It’s all about purpose. When I founded Chancellor Group, the goal was to be a single source for advice in all things financial. One person could pull it all together for a family, and then outsource those things that I could not do myself for my clients — such as wills, trusts and estates,’’ he said.

In 2014, his son, Scott, 45, also a CFP, joined the firm.

“Seven years ago, my son, Scott, joined me in my practice. He had a very successful career of about 16 years in banking as a commercial lender and relationship manager in South Carolina.

“We have always had good chemistry between us, and thoroughly enjoy working together. He brought with him the insights of working in large banks and the idea of having all our documents stored digitally in the cloud, with a new Client Relationship Manager system that is tailored to financial services professionals,’’ Clanton said.

Scott has four children, and one of Clanton’s favorite photos shows him surrounded by his grandchildren.

His older son, Ryan, a baritone, traveled the world touring with opera companies, and has been president and general director of the Minnesota Opera since 2016.

A Role Model on Many Levels

Beyond the family connections of working with his father in the food brokerage business and owning a financial services firm with his son, Clanton counts his relationship with Houston D. Smith Jr., his CPA for about 40 years, as an important influence in his life.

“I have to say that I modeled how I deal with clients after the manner in which he dealt with me. He was always kind, matter of fact, and you could ask him questions about life events that had nothing to do with accounting.

“He had two observations: In his practice, he doesn’t pay anyone who brings him a referral, and he doesn’t receive any payment if he sends someone a referral. He said, ‘I want people to know that if I send a referral, it’s because they will do a great job for the client, and bring credit to the relationship.’

“So, I incorporated that in my practice.’’

Clanton may have acquired another trait from Smith, who was working into his late eighties, and only “stepped back’’ from being CPA for Clanton two years ago.

Times are Changing

From the perspective of spending nearly 20 years in financial services, Clanton says the field has become “more complex, dictating longer and longer forms, with attention to more compliance.

“On the plus side, technology has democratized the industry, as we have access to the same type of analytical tools that used to be available only at very large firms,’’ Clanton said.

Chancellor Wealth Management has “about $95 million in AUM,’’ Clanton said, and serves 87 households. The firm requires clients have a minimum of $100,000 in assets, but Clanton said, “we do accept legacies without the imposition of minimums.’’

Investment services are administered on a fee-only basis, but Chancellor Wealth Management also sells life insurance, disability and long-term care policies, on a commission basis.

Clanton said he enjoys “learning about my clients; their hopes and dreams, their family, what they do to make a living, and helping them achieve their goals and dreams.’’

A New View on Retirement

And the lesson that Clanton learned when he briefly “retired,’’ after selling the food brokerage business, stays with him today.

“When I sold the business, I was in my forties, and I essentially retired. I didn’t have a plan of what I wanted to do next, and after about six months, I was bored and boring! That has been important for me to remember: Mine is not a business of moving large boulders from one side of the yard to another; it’s not physically demanding. As long as I can stay sharp, why shouldn’t I do it?’’

From a regular schedule of up to 60 hours a week in the food brokerage years, Clanton has reduced his work schedule to about 30 hours weekly.

More free time has enabled him to pursue several meaningful activities in recent years, such as currently serving as treasurer of his church, Christ the King Anglican Church of Atlanta; as a fee arbitrator for the State Bar of Georgia for about 25 years, and as a board member of the Superior Court Clerks’ Retirement Fund of Georgia, an appointment made by the governor of Georgia.

Calling her “the best influence in my life,’’ Clanton’s wife of 24 years, Cynthia H. Clanton, is an attorney, and since 2015, has been the director of the Administrative Office of the Courts, the State of Georgia Judicial Agency. The couple met at their church; Clanton said they have enjoyed traveling, pre-COVID, and as he says, “just spending time with her in general.

“She’s an extraordinary person who’s felt strongly about public service. I can still remember when I saw her for the first time,’’ he said.

In a four-decade career in journalism, Eleanor O’Sullivan has reviewed many books on best practices for financial advisors, has written for Financial Advisor and the USA Today network, and was movie critic for the Asbury Park Press.