Editor’s note: In this companion piece, caregiving expert Annalee Kruger writes about how families may need to budget twice as much as they anticipated for a caregiving facility if they have to hire a private-duty companion to supplement the limited care the facility provides.

Senior spousal caregivers (age 66 to 96) who experience caregiving-related stress have a 63% higher mortality rate than non-caregivers of the same age, according to the Family Caregiver Alliance. If Ethel is trying to take care of her husband, Marvin, who has advanced dementia and requires nonstop supervision and redirection, she is highly likely to suffer a stroke, heart attack, mental health issue or death if she does not have enough supports in place.

As an advisor, are you asking how your primary-caregiver client is holding up and what challenges he/she has? Do they have an aging plan? What will happen to the portfolio if Ethel dies, Marvin is no longer competent, and you don’t have a relationship with their kids/trusted contact? Is the primary caregiver on their way to becoming part of that 63% statistic?

And let’s take a step back: Does your client, their family or you even recognize that there is a problem going on?

“It’s highly likely your frail, elderly clients are not doing as well at home as you would like to think.”

It’s highly likely your frail, elderly clients are not doing as well at home as you would like to think. How much are you communicating with your now-aging clients?

Are you checking in on them often, asking what struggles they have at home, how they get to their doctor appointments, how they manage their medications and how they spend their day? Are they spending most of their time alone or watching TV?

The grim reality

Many frail seniors spend a good portion of their day in their recliner in front of the TV. Many of them are not eating healthy meals or drinking enough water (which then leads to dehydration and urinary tract infections) or not keeping their bodies clean. Further, they’re not walking around enough to keep their circulation and skin healthy, causing decreased physical activity and weakness. And many do not have meaning to their day or anything to look forward to.

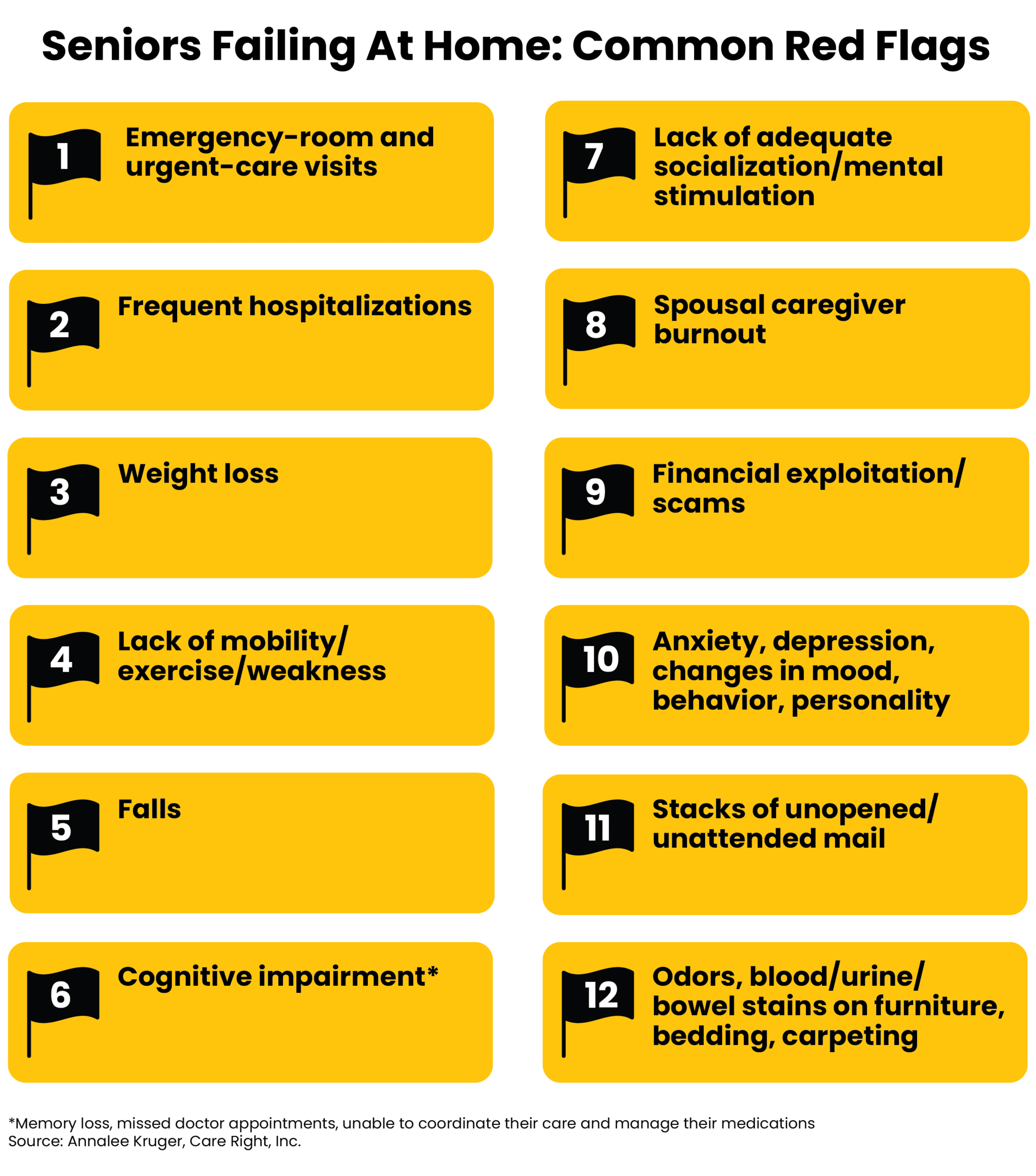

Nowadays, their adult kids don’t live nearby to regularly check on them or notice their loved ones are struggling or failing at home. The red flags are almost always there: We just need to be educated and know what they are. This chart, which pains a true but bleak picture on aging, includes the common red flags that signify aging clients are failing at home:

Get educated

How can financial advisors help their clients? For starters, refer to this chart to learn how to identify at-risk seniors.

In addition, learn about aging and dementia, caregiving, the costs of care, the current (and future) landscape of healthcare, the challenges of seniors aging at home, and the risks to seniors in healthcare settings. [Link to Annalee’s facility story].

Here are a dozen tips to help seniors get the best caregiving in a facility – or, as the first tip explains, how to avoid having to go to one in the first place. Learn about these tips and encourage your clients’ families to embrace them, too.

- Prevent hospitalizations and premature admission into a care facility by making sure seniors have enough supports in place at home and a professional care manager to troubleshoot issues.

- Know the Patient/Resident Bill of Rights.

- Learn how to be a bold advocate.

- Be present and be present often.

- Take pictures, document concerns and identify the person in leadership at a facility who can help improve care.

- Know how to file complaints with the state if the facility cannot or will not improve their care.

- Know the healthcare jargon.

- Educate yourself on your client’s health condition. We often work with families on their dementia journey and have no idea what to expect as their loved one’s disease progresses.

- Obtain consent to have a camera installed (not all facilities allow this, especially if it is a shared room).

- Make sure your clients have all of their necessary documents in order and updated, and verify there are no gaps in their plan. This includes a power of attorney, living will, long-term care insurance policies, accounts, etc.

- Develop a relationship with the trusted contact/family so if you have concerns about your aging client, you can involve their family.

- Hire a professional healthcare advocate. Although it’s an out-of-pocket expense, it can save seniors unnecessary hospitalizations and unnecessary/premature moves into a care facility — factors that can impact your clients’ assets under management. It can also prevent premature deaths.

Additional efforts

I also encourage you to become an Elder Planning Specialist. This ten-hour online course, offered through Plan4LifeNow and the Financial Planning Association, educates advisors on how to meet the changing needs of their aging clients. You can learn more about the initiative here and at Plan4LifeNow.com.

Finally, use a collaborative approach with caregiving experts and your clients’ other centers of influence instead of working in silos and hoping for the best for your clients. If we all started working together, our clients would have the best possible aging and caregiving journey.

Annalee Kruger is president of Care Right Inc. (a nationwide senior care planning/aging plan consultant and virtual patient advocate) and co-president of Plan4LifeNow (an education and financial planning consultancy teaching financial advisors to become Elder Planning Specialists). As a virtual and nationwide senior care planner and senior advocate, Annalee teaches advisors and families how to boldly advocate for their clients and loved ones. Her book, “The Invisible Patient: The Emotional, Financial, and Physical Toll on Family Caregivers,” is available on Amazon and Audible.