Truth to tell, women have long been on my mind — I grew up in a somewhat traditional household in a very traditional city, wondering why sons were often more favored than daughters.

Nowhere did this seem more true than in educational opportunities. Young men could pursue any career; young women were expected to marry, run a household and be caring mothers to their children. Their “careers” were foretold and foreshortened when they wed.

Women were not celebrated when they pursued what were thought to be “male” careers. One woman I met years ago went to law school and was the only woman in her class. She was jeered and laughed at and discouraged from speaking up in class. As far as I know, after graduating she never sought a job in the profession she trained for, but stayed in her parents’ home, not working, well into her adult years.

Even today I know — and want to help — young women who are behind in financial literacy, have trouble making decisions about money and will not seek financially related jobs. At the same time, I have met young women who want to learn about and take on more responsibility in their financial lives.

One example is a group of Yale University students, all women, who called my office and asked me if I could speak to them. They said they could not graduate until they had some financial knowledge. I think without knowing it, I had waited for such a call: to champion education that I feel is very important to put one on the path to a full adult life.

I have also met older women who defer to their husbands in matters of finance. Sometimes, they are even the primary earners in their household. These women may claim not to understand anything financial, while feeling that’s not right. Often, they want to do better so their daughters will.

How cohesive are widows?

I often meet widowed clients at our financial planning firm who are bewildered about what to do now. They are sometimes cautious, sometimes careless, but are trying to find their new path. Some have young children to raise. Others are thinking about their senior years. Yet with their husbands gone, they often feel they have no one to ask for help.

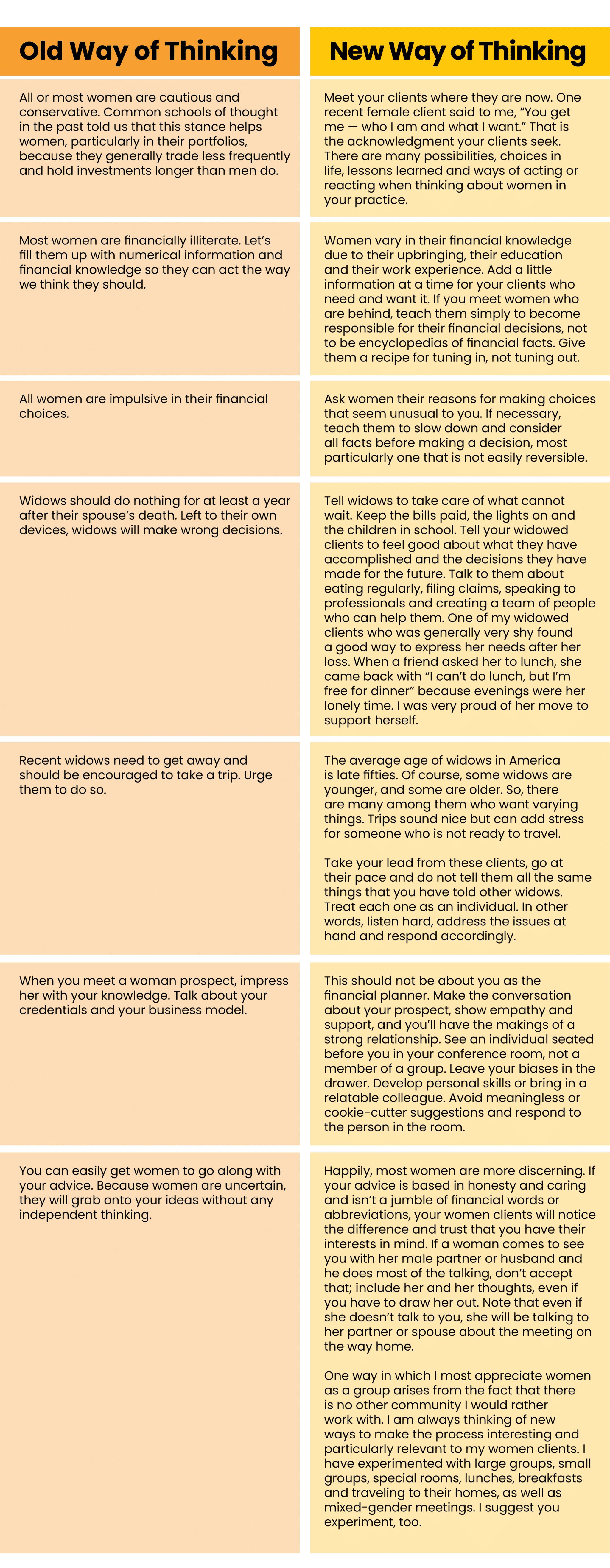

How can we assist them? By teaching women to think for themselves, to realize they can take the necessary steps, to believe that they are competent and astute, and to understand that they can make decisions about finance for themselves. Give women clients more credit for what they can learn and can do. Adjust your opinions to include a new way of thinking about women.

Here are some ways that that adjustment to thinking can play out with your clients:

New Beginnings

In October, Dr. Claudia Goldin, a professor of economics at Harvard University, won the Nobel Prize in Economics for her decades-long work regarding patterns of women’s work and the gender pay gap over time. She will serve as a role model for young women now and in the future who might have thought economics was not a field for them. We were fortunate to have Dr. Goldin address our women clients at a meeting two years ago.

Additional Reading: Should You Advisor Your Clients to be Executors?

If you don’t know how financially savvy the woman you are about to meet with is, give her the benefit of the doubt. Talk to her as you would to any thoughtful, intelligent person. She will reward you with her new interest in finance, thoughts on her lifestyle, considered questions about her choices and a window into her personal values. This can be the beginning of a long-lasting advisor/client relationship.

Karen Caplan Altfest Ph.D., CFP®, is executive vice president at Altfest Personal Wealth Management. She helps many of the firm’s clients with a variety of investment and financial planning issues and specializes in helping women clients and widows. Karen’s Financially Savvy Woman programs, including the Women’s Financial $paTM, are popular with clients. Her focus is to educate and empower women.