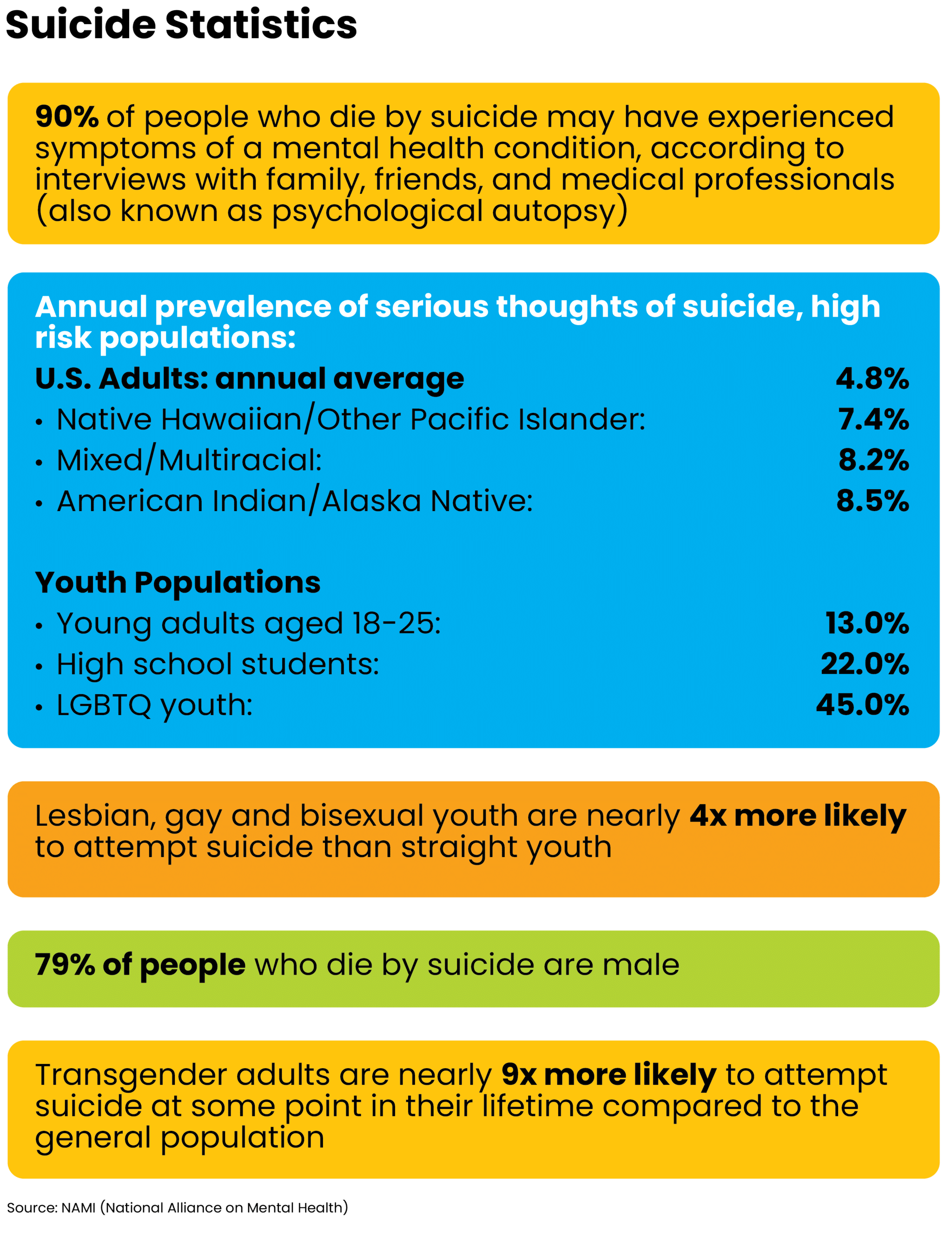

Authors’ note: In our previous article, we discussed that money and mental health are inseparable. Here we further discuss this interconnectivity and why it’s important for advisors to become more aware of it. Mental health problems are more prevalent than many people realize. We hope that by continuing to raise awareness of mental health, we can help advisors recognize problems. We also hope to provide comfort and healing to families that have lost loved ones to mental illness and suicide.

A financial advisor today who wants to have meaningful and impactful client relationships can’t avoid paying attention to mental health.

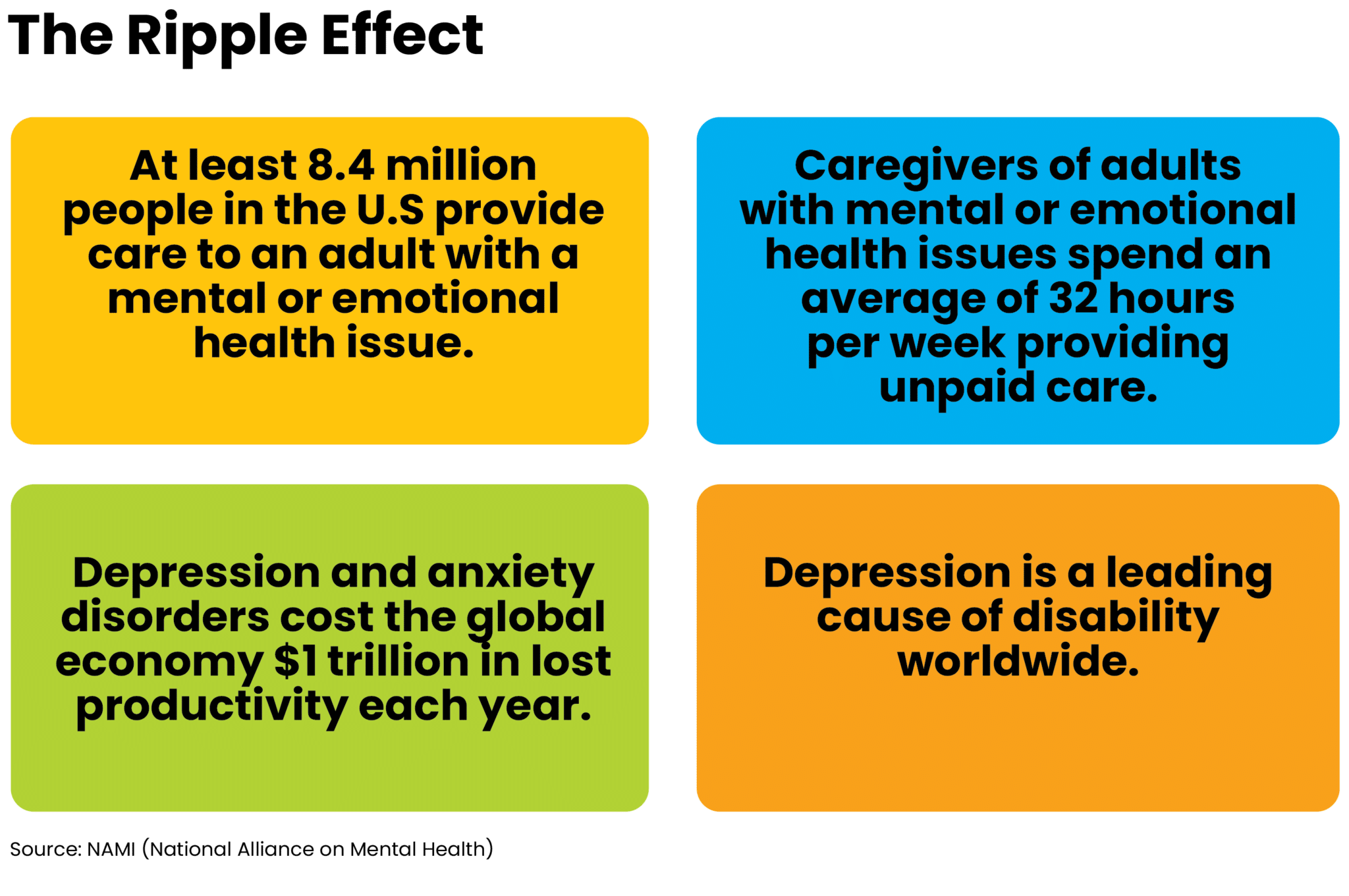

In the United States, more than one in five U.S. adults lives with a mental illness, according to the Centers for Disease Control and Prevention. There are also approximately 13 million Americans who support adults with mental health conditions.

Money and mental illness

Money issues can affect mental health and vice versa, so it’s not surprising that financial advisors will need to consider these impacts. Worrying about money — whether people have a lot or a little — leads to difficulty managing money because people feel they cannot change the situation. This can start to impact their mental health by affecting their feelings, thoughts and behaviors. Several studies have demonstrated a cyclical link between financial worries and mental health problems such as depression, anxiety and substance abuse.

The stress of debt and financial uncertainty leave many individuals anxious or depressed. That decline in their mental health makes it harder to manage their money. Suddenly, it’s even harder to concentrate and have the energy to tackle a mounting pile of bills. Taking time off from work due to anxiety or depression can also cause loss of income.

Ultimately, these difficulties managing money trigger more financial problems and worsening mental health problems. It’s easy to get trapped in a spiral of increasing money problems and declining mental health.

What can an advisor do?

No. 1, an advisor can encourage nonconfrontational conversations with clients that build trust and get clients to open up about money issues. When a person is facing money problems, there is too often the temptation of keeping issues to themselves and “bottling” up everything inside. Many individuals feel awkward about disclosing the amount they earn or spend, feel shame about the financial mistakes they have made, or embarrassed about not being able to provide for their family.

It can help people with mental health or emotional issues to hear they are not alone — that others face similar struggles. As an advisor, you can also point out that you can alleviate some of their stress by helping them get their financial situation organized. The plan will provide comfort, organization and clarity during a time that might be cloudy and confusing.

It can help people with mental health or emotional issues to hear they are not alone — that others face similar struggles. As an advisor, you can also point out that you can alleviate some of their stress by helping them get their financial situation organized. The plan will provide comfort, organization and clarity during a time that might be cloudy and confusing.

The financial plan should include action steps for the person to follow that will address issues one at a time so they don’t get overwhelmed and more stressed. Include some high-value, low-effort steps that get them started — assure them they can tackle steps that require greater effort when they feel up to it. You will want to make sure you ask important questions, help them devise a budget, and make them feel like they are in more control of their financial lives.

It also helps if the advisor can keep the family and support providers, including caregivers, up to date on financial matters. These kinds of discussions provide the family with an opportunity to express their concerns about their own financial stability and overall finances, as well as the stress they are facing.

It also helps if the advisor can keep the family and support providers, including caregivers, up to date on financial matters. These kinds of discussions provide the family with an opportunity to express their concerns about their own financial stability and overall finances, as well as the stress they are facing.

As financial advice professionals, we have the benefit of seeing the big picture in our clients’ lives. When advisor are doing their jobs right, they not only get an overview of clients’ earnings, spending, savings and investing. They see their hopes, dreams, fears, habits, anxieties and limiting beliefs…and sometimes into the state of your mental health.

And while financial advisors often joke about serving as therapists as much as trusted financial guides, that’s closer to the truth than most people think.

Larry Sprung is a wealth advisor and the founder of Mitlin Financial. Keena Pettijohn is the founder of Lifelogixs Strategic Consultancy Group. Together, they have over 50 combined years of financial services experience.