I enjoy speaking to financial advisors because that’s a key to my learning, even with well over a quarter century in the industry. More importantly, I meet financial advisors who are terrific, caring people who truly put an effort forward in their desire to help and serve others. Such was the case in my interview with Mike Zung of Java Wealth.

Mike, a 40-something advisor with CFP credentials, spent almost two decades in information technology as a software engineer, architect and director. Although Mike found his work highly satisfying, he caught the bug to do something different and help change people’s lives. It was not an easy decision to walk away from corporate life to follow his passion for personal finance. But thanks to his supportive spouse (with whom he shares two young children), he joined the XY Planning Network and launched Java Wealth Planning.

Mike’s niche practice focuses on tech professionals. Using his first-hand experience in the tech industry, he helps clients better navigate their financial lives. For example, he helps them figure out how to handle job changes, contract positions, promotions and bonuses, stock compensation, ESPPs and benefits packages. He also discusses how they can balance their jobs family and outside interests.

As Mike has found, not all financial advice is based on pure scientific facts. Sure, Monte Carlo simulation is based in part on facts and formulas. But it’s also based on varying assumptions so it delivers a range of possible answers to questions, such as “Will I have enough money to retire?” You can imagine the variables that are considered: security growth rates, inflation, interest rates, economic conditions, worldwide political conditions, supply chain issues, shortfalls and overages of commodities and resources, and on and on.

When a high-quality financial advisor gives clients their advice, they consider myriad data that has been sliced and diced in many ways and share what’s really important for that individual client’s wants and information preferences. Most clients only want to hear what’s relevant to them: what actions to take and the core rationale.

Meeting clients where they are

Mike studies the factors and variables and puts together plans intended to help each client meet their goals. He offers quarterly meetings with each client and is available for ad hoc meetings. Mike personalizes his client meetings in several ways.

- Being relatable. He understands his clients’ work, skill sets, compensation models and internal drivers.

- Communicating visually. Mike knows his clients are primarily visual learners who understand graphic presentations. He has the technical skills to deliver information — not merely data — in a way they relate to and understand.

- Employing technology. Rather than solely relying on his memory for hundreds of client situations, Mike uses various tools that help him.

For example, Mike uses checklists and flowcharts from fpPathfinder, a company co-founded by financial advisors Michael Kitces and Michael Lecours. These tools give Mike a systematic way to ensure nothing falls through the cracks. The checklists and flowcharts raise planning issues and identify decision points, which can be used to help facilitate more productive client conversations.

For example, one of the checklists, “What Issues Should I Consider Before the End of The Year?” addresses issues related to asset & debts, tax-planning cash flow, insurance planning, estate planning, and many other life and planning issues. Another checklist is “What Issues Should I Consider If My Spouse Passed Away” — a subject that is hopefully not top of mind.

The written, visual explanations provided by fpPathfinder’s checklists and flowcharts can be particularly helpful to seniors because they can be reviewed multiple times and used to generate questions that may need further explanations to meet each client’s particular situation. The product is also continually updated based on user requests, research and relevant legislation. [Disclaimer: I do not work for fpPathfinder; nor do I receive compensation from them. I did receive a complimentary subscription for their base product, but they did not ask me to prepare an article that speaks about their product.]

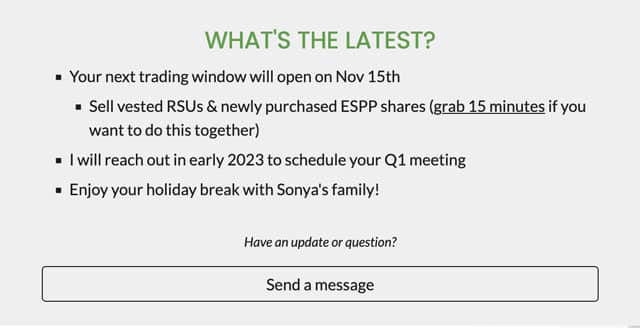

Mike also uses Google Sites & Google Sheets templates, and personalizes every client’s online dashboard with their financial current snapshot in an appealing way. This is an industry-leading approach. Mike calls the dashboard, “Your Money Café.” The dashboard (here is a sample) is part of all of Mike’s client meetings and is available on his client portal 24/7/365.

“Your Money Café” includes personalized sections such as:

It also shows the client’s personalized:

- SWOT analysis.

- Current financial positions — net worth, income, savings rate.

- A pictorial of the client’s net worth.

- Savings goals.

- Family calendar that visualizes upcoming milestones, large purchases and other major events.

- Annual cash flow estimates showing all inflows and outflows.

- Detail breakdowns of major income and expense categories.

- Equity compensation overview for RSUs and stock options.

- If relevant, Mike will include an fpPathfinder checklist or flowchart that will help a client work through an issue they are dealing with (for example, the “What Issues Should I Consider When Reviewing My Estate Planning Documents?” checklist).

Suffice it to say, this is by far the most personalized representation of a client’s financial life I have seen and it provides the basis for a key part of Mike’s quarterly review agenda. It should be noted that several software developers offer one-page financial planning capabilities. RightCapital has a customizable snapshot feature and Envestnet/MoneyGuide offers a “digital plan summary” called “My Snapshot.” eMoney Advisor offers a summary with a retirement plan score, scores for other goals and asset allocation called “The Plan Summary Report.”

Mike, who uses RightCapital to provide a pictorial of clients’ net worth, further personalizes his “Money Café” beyond what is offered by standard planning software. His offering requires individual attention, which makes it less scalable or streamlined than off-the-shelf tools. However, it gives Mike the option to provide more highly customized capabilities, especially for high value clients.

Shorter, focused-financial plans may also be better suited to seniors than long reports with extensive cash flows, disclaimers and Monte Carlo simulations. That’s because seniors have a naturally shorter timeframe and different issues, such as decumulation instead of accumulation.

Mike recognizes that no one tool will drive business and that changing client behavior goes beyond technology. Still, the tools he uses allow him to focus on that bigger picture and he is confident that he is delivering solid, truly personalized advice. In a bit over four years, he has achieved virtually 100% client retention and the prospect for as much growth as he wants and can manage.

David Leo is founder of Street Smart Research Group LLC. He is an author, speaker, coach, consultant, and trainer to financial professionals. David has worked with the financial services industry for decades, originally as a consultant with IBM and then with UBS/Paine Webber before starting his own firm. If you would like more information about his services, contact him at David@CoachDavidLeo.com or visit www.CoachDavidLeo.com.