Question: What do the following products and strategies all have in common?

- Tax-Free Retirement Account

- Section 7702 Plan

- Private Reserve Account

- The Laser Fund

- Bank on Yourself

- Infinite Banking

Answer: They’re all cash value life insurance.

These are all just creative marketing names to describe life insurance policies. I struggle to see how salespeople are allowed to pitch life insurance by calling it words like “account,” “fund” and “bank.” I don’t know how FINRA, the SEC and the Federal Reserve are okay with this, but I digress.

Life insurance Is First and Foremost Life Insurance

In addition to paying out an income tax-free benefit upon the death of the insured, life insurance can have valuable ancillary benefits such as the ability to accumulate a tax-deferred cash value and the ability to take personal loans collateralized by said cash value.

I understand and appreciate these secondary benefits of life insurance. However, it’s important to keep in mind these secondary benefits are just that: secondary benefits. Life insurance is always first and foremost life insurance. In fact, insurance salespeople technically aren’t even allowed to sell life insurance to clients who don’t have a legitimate need to insure the loss of their lives. As such, policies can’t be sold solely for their ancillary benefits.

I Appreciate Life Insurance, But Not Inappropriate Sales Practices

I often speak critically of the life insurance industry. However, my criticism isn’t with the product itself; it’s with the industry’s sales tactics.

I appreciate life insurance. I personally have lots of life insurance (arguably more than I need).

What I don’t appreciate is the often deceptive and misleading way in which life insurance is sold. This is especially true for cash value life insurance, which is heavily pitched within the retirement planning circles I’m in. It’s not fair to the unsuspecting public who often don’t know it’s life insurance they’re being pitched.

A Real-Life Example of a Pitch for Cash Value Life Insurance in Disguise

Whether it’s through YouTube videos, posts in Facebook, webinars, local seminars or even good old-fashioned print media ads, there is no shortage of salespeople pitching cash value life insurance with As Seen on TV pomp and flare. However, many times you’d be hard-pressed to see or hear any mention of the words “life insurance” in the pitch. Often times, those words are relegated to being stuffed into a footnote or disclaimer.

For example, here’s a recent exchange I witnessed in a retirement planning Facebook group between an insurance salesperson (who doesn’t outwardly make it known she sells insurance) and another group member:

Original Post: “If you had just $1,000 to start saving for your teen what would you do with it?”

Insurance Salesperson: “Laser Fund”

Group Member: “What’s that?”

Insurance Salesperson: “It’s amazing! I’d love to tell you more about it”

Responder: “What’s the ticker?

Insurance Salesperson: “I’m sorry?”

Responder: “What’s the ticker symbol of the fund? I’ll take a look”

Insurance Salesperson: “It’s not a stock”

Responder: “But you said fund. So isn’t there a ticker? Or is it a private fund like a hedge fund or something? I don’t think hedge funds have tickers”

Insurance Salesperson: “It’s a financial vehicle that is properly structured to be max-funded and tax-advantaged”

As it can be seen, there was literally no reference from the salesperson that the “fund” is actually life insurance. Even when it became clear to the responder that it’s not a fund, the salesperson started calling it a “financial vehicle” instead of life insurance.

Is what the salesperson said entirely false? No, other than the fact that the word “fund” was used to describe it. Was the description fair and accurate? Far from it.

The product in reference was life insurance and that should have been made clear. It’s that simple. Calling it anything else is confusing at best, deceptive at worst.

Misleading Sales Pitches Don’t Help the Industry’s Image

It’s no secret that the life insurance industry has historically had a heavy focus on sales, and sometimes with questionable sales tactics. While it still has a strong sales culture (which is par for the course when compensation is mostly or solely from commissions), it’s nonetheless trying to shake off the vestiges of its overt sales image and rebrand itself more as an industry that advises and educates.

As you can see in one my previous Rethinking65 articles, Are You Really A Financial Advisor?, I fully support the financial services industry’s movement toward real advisory services and not just selling products (or gathering assets to manage). But I guess old habits die hard, because pitches like the one from the Facebook group are fairly common and don’t help improve consumers’ perceptions about life insurance or those who sell it.

If It Looks Like a Duck…

In my opinion, if the life insurance industry wants to improve how it’s perceived and improve how cash value policies are sold and used, it should be more forthcoming with how the product is represented.

For example, instead of trying to call it everything other than life insurance, be upfront about the fact that it’s life insurance. And only then explain how it has multiple other potentially valuable features beyond just paying out a death benefit.

Cash value life insurance ancillary benefits like tax-deferred cash accumulation and borrowing abilities are important features that should definitely be explained to prospective purchasers. But don’t lead with those things. Lead with saying what the product actually is; don’t try to hide or gloss over the fact that it’s life insurance.

With honest and thorough education and explanations of the product and its benefits, consumers who could truly benefit from life insurance would see the value and make the purchase. On the other hand, if you feel the product needs a fancy marketing name to redirect consumers’ attention away from the fact it’s life insurance, that should tell you something.

Life insurance is important. Calling it something it’s not and trying to hide the fact that it is life insurance cheapens and degrades it. For the sake of the industry and consumers alike, let’s call it what it is.

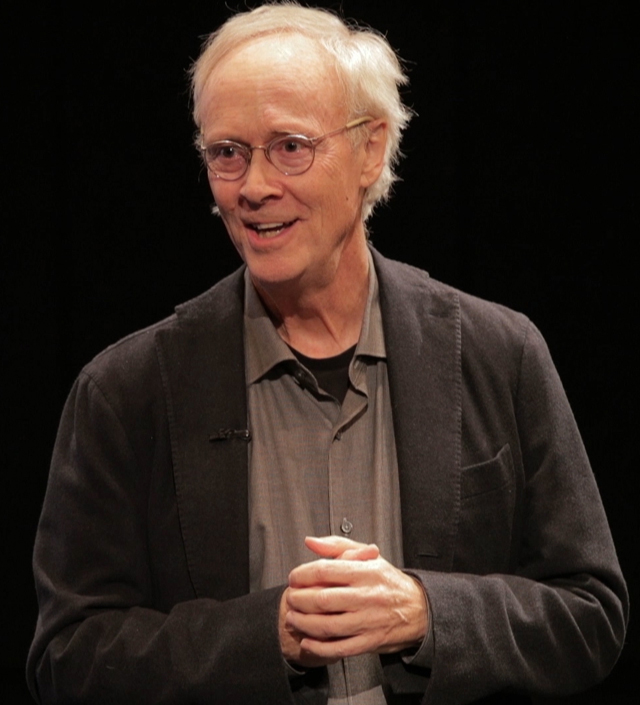

Andy Panko, CFP, RICP, EA is the owner of Tenon Financial, a fee-only firm in Metuchen, N.J. that provides tax-efficient retirement planning and investment management. He’s also the founder and moderator of the Facebook group, Taxes in Retirement and creator of the YouTube channel, Retirement Planning Demystified.