Just how much do taxes reduce the amount of income available to people in retirement? The Center for Retirement Research at Boston College decided to find out.

The study, led by the center’s director, Alicia H. Munnell, and its assistant director of savings research, Anqi Chen, aims to show how much federal and state income taxes impact retirement income for recently retired households in various income categories. The project used data from the Health and Retirement Study, a nationally representative longitudinal survey of older Americans.

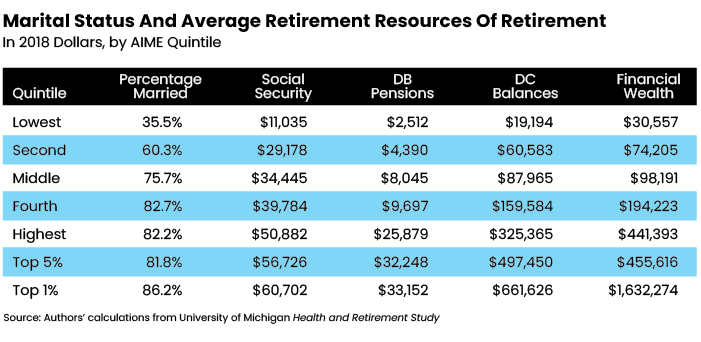

While the study, released in November, shows the average tax burden is about 6% of retirement income, it is nearly double for the study’s highest income quintile. Those in the top quintile were mostly married, had average combined Social Security benefits of $50,900, 401(k)/IRA balance of $325,000 and financial wealth of $441,400. The top quintile faces an average income taxes liability of 11.3%, the study found.

“The fact that they constitute the highest quintile highlights the fact that most households do not have a lot of money in retirement,” the report said. “Yet, they will pay about 11 percent (or 12-13 percent for other drawdown scenarios) of their retirement income in taxes. Given that, without considering taxes, about 40 percent of households in the top third of the income distribution are at risk of not being able to maintain their standard of living, taxes will make the goal even more difficult to attain.”

Depending on drawdown strategies, the study found, effective taxes ranged from 16.4% to 17.9% for the top 5%, whose average 401(k)/IRA holdings are about $497,500, and 22.7% to 25% for the top 1%, whose average 401(k)/IRA holdings are about $661,600. The total financial wealth of the top 1% was $1.63 million.

“Thus, taxes are an important consideration for those who hold meaningful balances and should be considered in their financial planning,” the study said.

The tax liability percentages don’t change much even when drawdown strategies are changed, the researchers noted.

The tax liability percentages don’t change much even when drawdown strategies are changed, the researchers noted.

According to the study, “many households may forget that not all of these resources belong to them; they will need to pay some portion to federal and state government in taxes. Roughly half of households owe federal taxes on their Social Security benefits. In addition, about two-thirds of households will have some income from employer-sponsored retirement plans, where they will face taxes on their defined benefit income or on withdrawals from any traditional tax-deferred defined contribution plan. In other words, when looking at their accumulated resources, households approaching retirement may think they have more saved up than they will actually have available.”

Most households’ retirement resources are mainly Social Security benefits, and many people pay little or no taxes are paid on them. However, that’s most likely not the case for clients of financial advisors. Only individuals with less than $25,000 and married couples with less than $32,000 of modified adjusted gross income don’t pay any taxes on those benefits, the CRR study noted. Single recipients with income up to $34,000 and couples up to $44,000 pay taxes on 50% of Social Security benefits; recipients exceeding that amount of income pay taxes on 85% of benefits, the study observed. About 55% of households receiving Social Security now pay taxes on their benefits and that share is expected to rise to 58% by 2030, the researchers said.

The CRR project focused on households where at least one earner, at least age 62, has claimed Social Security benefits from 2010 to 2018. Its sample included 3,419 individuals and 1,907 households.

Little information is available on drawdown patterns from retirement assets, so the researchers estimated taxes based on a few scenarios. Their base case assumed households did not withdraw from 401(k)s or IRAs until required and only withdrew what was mandated by required minimum distribution (RMD) rules.