Americans are living longer than ever, with an average life expectancy of 77.5 years. Although this is good news, it adds a layer of complexity to retirement planning. Your role as an advisor is to help clients create a vision for what their post-work life will be like, initiate sometimes difficult planning discussions to ensure that their savings meet their needs, and provide insights that will help boost retirement savings. Here’s how to help prepare them confidently for the road ahead.

Lay the Groundwork

Many retirement discussions may start with you prompting your clients to carefully examine their wants and needs in this phase of their lives. They’ll need to trust you throughout the process because they may have behavioral biases preventing them from making changes or thinking differently about their financial picture. When do they expect to retire, and when should they retire? What are their goals and dreams? Do they want to leave an impact on charities or a legacy for their family?

Exploring these questions can be enjoyable, yet beneath them lies the most challenging factor: estimating the necessary regular income. Reflecting on retirement goals also involves attempting to calculate expenses—a difficult task given the many unknowns. But this effort is essential in determining how to replace income to cover these costs effectively.

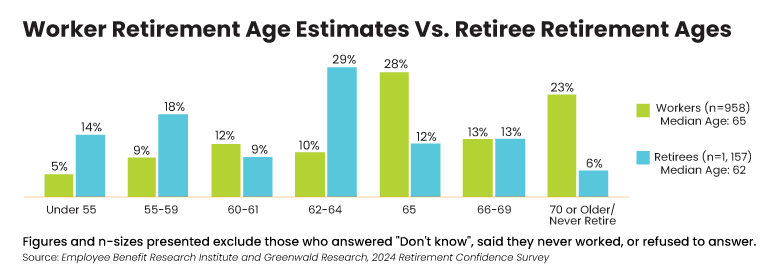

Another uncertainty could be the right age to retire. Although Americans today expect to delay their retirement later than previous generations (most expect to leave the workforce at age 70 or later), 49 percent of retirees will leave the workforce earlier than expected because of a medical issue, changes at their company, or even a realization that they can afford to do so, according to the Employee Benefit Research Institute’s “2024 Retirement Confidence Survey.”

Explore Multiple Avenues

Once you’ve laid the groundwork and established your client’s goals, it’s time to map out how they can achieve them to boost retirement savings. To understand all the assets available for their retirement years, have clients dig up documents from any accounts that fall outside your relationship, such as pensions and 401(k)s that were never rolled over. Also, remember to walk clients through other potential sources of income so you can consider their overall income needs or capacity.

Social security. This is one of the first places to look for income—but it should not be the sole source. You’ll want your clients to create an account on ssa.gov if they haven’t already. They should check if their earnings history is correct (mistakes are rare, but they do happen) and that they have enough credits to qualify (i.e., a minimum of 40 credits or at least 10 years’ worth of earnings). They’ll also want to see their estimated primary insurance amount, which is based on their 35 highest-earning years. Any recent social security statement should have all this information and show the different benefit amounts depending on when they file for benefits.

As for the timing of when to file, there is no one size fits all. For some clients, it may be reasonable to delay until age 70, while others might need the funds sooner. Start with the client’s full retirement age. As a broad stroke, the break-even point between filing at full retirement age and delaying filing until age 70 for the total benefit received is usually around ages 78–81. When filing early, this break-even point is typically around age 72. View the most recent updates and changes to social security from 2024 to 2025.

Retirement and investment accounts. The next significant tranche can be a doozy to explore: Your clients may have collected a whole slew of accounts as advisory relationships changed and they switched jobs, possibly even shifting from public retirement accounts to 401(k)s. They may have even forgotten some accounts from short-term jobs.

Dividends and interest from taxable accounts. For clients who need help thinking about taking any money out of their accounts, this can be a good place to begin. One strategy to consider: elect not to reinvest dividends. Allow them to accrue and send the funds to the clients on a periodic basis. To your clients, it will feel like they’re still getting a paycheck. Smaller withdrawals like this, if their overall income needs are being met, can gently transition them into being comfortable with the drawdown phase.

Tax-deferred accounts. These can be a good starting point for drawdowns when you have clients who are retiring on the younger side. One strategy is to supplement their income with a distribution that would put them at the edge of their current tax bracket. They can then make full use of the tax bracket they are in or expect to be in and reduce future RMDs.

This strategy works best if the clients only spend what they need from this distribution and save any remainder to a non-retirement account (e.g., a taxable investment account, high-yield savings account, or similar vehicle). Taxable accounts and tax-free accounts should be used only as needed. They are effective at supplementing income without creating an excessive tax burden for most situations, but they are also effective assets to leave to non-charitable organization beneficiaries.

Visualize the Future

Helping clients boost retirement savings entails being reasonably sure whether the accounts are significant enough to support 30 years of retirement. It’s not an exact science because circumstances can change. Your clients, for example, may end up taking fewer vacations as they age, or their medical needs may increase.

The 4 percent rule. The concept of 4 percent as a safe withdrawal rate became a rule of thumb based on William Bengen’s research of historical returns between 1926 and 1994. Bengen found that a hypothetical portfolio of 50 percent stocks and 50 percent bonds based on index returns would last 30 years, even in a worst-case market scenario, if a retiree started with a 4 percent withdrawal rate and adjusted for inflation as years progressed.*

In truth, though, the 4 percent “rule” should be viewed more as a guideline. It does offer an easy way to illustrate how changes to your clients’ accounts will occur over time and meet their retirement income needs. Keep in mind that retirees tend to spend more in the early years of retirement and scale back over time. But the recommended rate can fluctuate from as low as 2.9 percent to 10 percent, depending on the length of retirement. Recently, Morningstar recommended a 3.8 percent withdrawal rate, which accounts for inflation along with market movement.

The bucket strategy. The bucket strategy is used to mitigate longevity risk, and it presents another opportunity to explain retirement income needs. Put in place a few years before retirement, this strategy entails dividing assets into buckets that have different time horizons, asset allocations, objectives, and risks. Retired clients first pull from bucket one and then move on to the others as time passes, or a system could be implemented to replenish the first bucket from dividends and interest from the other buckets.

Plan Proactively Today for a Smoother Tomorrow

Discussing ways to boost retirement savings now can help you vet issues that may come up years in advance of your clients’ goal retirement date. Tapping into an additional pool of expertise can make all the difference in setting both you and them up for success.

At Commonwealth, our goal is to provide you with top-notch planning and portfolio advice, thanks to our wealth of in-house financial professionals and holistic investment solutions—including our Preferred Portfolio Services® (PPS) asset management platform, which allows you to outsource portfolio management to Commonwealth so you can focus more of your time and energy on client relationships.

Kevin Smith is a private client consultant with Commonwealth’s Advanced Planning team. With the firm since 2020, he manages advisor requests for support with HNW and UHNW clients and collaborates with subject matter experts. Kevin holds the CFP® designation, FINRA Series 7, 24, and 66 securities registrations, and is currently pursuing a JD at the Massachusetts School of Law.

Third-party links are provided to you as a courtesy and are for informational purposes only. We make no representation as to the completeness or accuracy of information provided at these websites.

* This is a hypothetical example and is for illustrative purposes only. No specific investments were used in this example. All indices are unmanaged, and investors cannot actually invest directly into an index. Unlike investments, indices do not incur management fees, charges, or expenses. Actual results will vary. Past performance does not guarantee future results.

This post originally appeared on Insights, a blog authored by subject-matter experts at Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser.