If you’re feeling frustrated as a financial advisor … listen up. Considering all the stuff that we have to deal with between compliance, practice management and, of course, marketing, there is plenty to be [potentially] frustrated about.

At my highest point of frustration (and lowest point emotionally in my career), I never would have imagined I’d be able to start equipping financial professionals through a community movement sharing knowledge I acquired as a financial advisor. It’s been a rewarding experience to use what I’ve learned from working with my clients and using that to shape the next generation of financial advice.

A Typical Career Beginning

I worked at a job I no longer hold (LOL). The drill is the same for most I speak with: Bouncing from firm to firm or experience to experience until you finally find your stride.

Along this journey, you start figuring out what you’re good at and what you like to do. I read blogs and articles that resonated with how I wanted to render financial advice, but wasn’t what I was doing daily at the firm I worked for.

A Big Part of My Frustration

It’s difficult to masquerade being a fiduciary when all you do is sell investments, insurance or any number of solutions that act as “band-aids” to the client’s problem.

When people hire us, I’ve discovered that they don’t really know what they want because a lot of “pre-conditioning” took place before they ever sat across from us. When they finally show up, they may be intimidated (at the least) but most likely very frustrated with their current results.

I believe the only way to show up for them is with R(elatable) E(mpathetic) A(ttentive) L(istening), or “REAL” financial advice. This is where I felt the industry was headed in the future, which gave me hope that people could win with their money, make better decisions and live a better life altogether.

When I think about the type of planning I do for my clients now, I would be able to serve very few relationships in the pure “investment management only” model. Many of my clients only have assets inside their 401(k) but still require comprehensive financial planning. How does that happen when you call investment management “financial planning”?

So for any of you out there currently feeling conflicted about what you’re “supposed” to do versus what you feel is right for the client, stay tuned …this story gets better.

My Decision

If you’re a knucklehead like me or at least a little weird, you probably will try and change the firm for which you work. This is a bad idea.

Here’s why … the firm owner(s) have more than likely had an epiphany at some point and created the environment in which you now are employed. I’ve found that more often than not, your aspirations to change that are insulting. So if you want to avoid future conflicts [of ideology on the delivery of financial advice], it’s best you take the path of least resistance and start planning your exit.

In the end, it is the plan of least resistance because it is best for all involved. Best case is that you’re so invaluable they choose to hear and maybe accept your ideas; worst case, you are happier by leaving to start your own. Personally, the harder I pushed for changes to the firm’s planning philosophy and framework, the worse the relationship with the owner got. I finally got the picture that it would be me leaving — not him.

All Wasn’t Lost

During my tenure there, I actually experienced leaving the wirehouse and going to a hybrid model, as well as then going independent. So I was really familiar with how the process worked and what it took to execute an “exit plan.” I was then further emboldened by listening to and reading material from Michael Kitces on how to start your own RIA. My exit plan wasn’t perfect, but with this knowledge I made the leap, and in 45 days I was running DJH Capital Management (a registered investment advisory firm in Texas).

I started with one client and very little assets to manage, but I was finally FREE! Was it easy? No. Was it scary? Yes. Was it worth it? H*ll yeah!

I wouldn’t have changed this for anything … more on that later. I remember one of my first cases involved a young lady I used to attend church with and who had inherited some money from her father. A registered representative from the insurance company that managed her father’s 403(b) plan rolled the money into an IRA for me client and talked her into putting the funds into a variable annuity product.

The problem was that the annuity was registered to her as if she were the original IRA owner instead of the beneficiary. As you may or may not know, RMD calculations are different for individual IRA owners and beneficiary IRA owners. This mistake had some important tax ramifications. Only in her 30s, my client wouldn’t be required to take RMDs unless it was registered as an inherited IRA. We didn’t want to take a chance that years later the IRS would want this corrected and hold her liable for penalties and taxes on years of unmet RMDs.

I remember the relief she felt after our first meeting when I explained how investments belong inside a comprehensive plan. We decided that the annuity wasn’t the best fit in her situation since she was relatively young and it had been registered incorrectly. We canceled the contract and had that check deposited into the correctly registered (inherited IRA) and put her into a diversified portfolio. We not only avoided this potential problems from the annuity, but with her inheritance we were able to help her transition into a career that was more fulfilling.

Something More Amazing

I had a marketing problem. That’s right. Can you believe it? A financial advisor with a marketing problem.

I reached out to a consultant and here’s where the story gets interesting: I became a client of his firm, and through that relationship, I start learning about the marketing problems of advisors (mainly by discovering my own).

Long story short, I became a coach and consultant with his firm, which over about two years allowed me to speak to dozens of advisors about practice management, marketing techniques and growing a successful practice.

It’s so funny because although that relationship ended, it forced me to do the hard work most advisors avoid in finding an ideal client avatar and developing a message that resonates with that ideal client.

More Good Fortune

I decided that if I was going to coach others, I needed a coach. So I hired someone to help me produce really great videos on YouTube. She suggested that I do a video on a “Day in the Life of a Financial Advisor.” To be honest, I didn’t think it was a good idea because I wanted to use video and YouTube to attract wealth management client for my RIA, and I felt they wouldn’t be interested in what goes on in my day. Right?

Kinda. They weren’t, but aspiring financial professionals were.

Fast forward, and I now have a consulting firm (The Jumpstart Coaching Lab), which is designed to teach aspiring financial advisors how to impact lives with REAL financial advice.

Suddenly, I was experiencing the freedom (emotionally and mentally) that I wanted because I was able to deliver comprehensive financial planning advice to my wealth management clients while sharing those experiences with the next generation of financial professionals.

An Exciting Future

The next generation of financial advice is in good hands. Today’s career changers and aspiring financial professionals have a desire, more than I’ve seen in previous generations, to see wealth generation become the norm for everyone.

More advisors today are finding ways to help groups who had little access to professional financial planning. I’ve seen several models including group coaching and online courses be a means to delivering great financial education and advice. I truly believe the sky is the limit and the “delivery of advice” will continue to evolve.

This really embodies the vision of Jumpstart, which is to see financial professionals well equipped to help change family trees through rendering great financial advice. I think this happens through delivering R(elatable) E(mpathetic) A(ttentive) L(istening) financial advice.

I’ve got big plans for making the platform not only a world-class coaching and mentoring experience, but also expanding to CFP review courses, career placement services for aspiring financial professionals, and a business incubator for existing financial professionals to launch and grow their own firms.

For now, I’ll continue to split my time 50-50 between both businesses because I know I’m having impact and changing family trees by helping one family at a time, one advisor at a time.

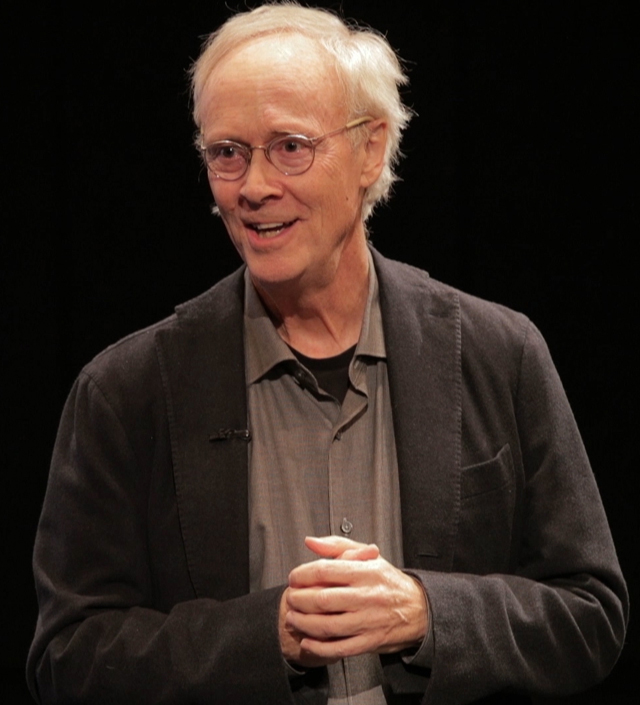

Dominique Henderson, CFP, is founder of DJH Capital Management, a registered investment advisory firm helping GenX clients implement sound investment strategies that produce cash flow during retirement. The Jumpstart Coaching Lab is his consulting firm that teaches and coaches financial professionals how to impact lives with REAL financial advice.