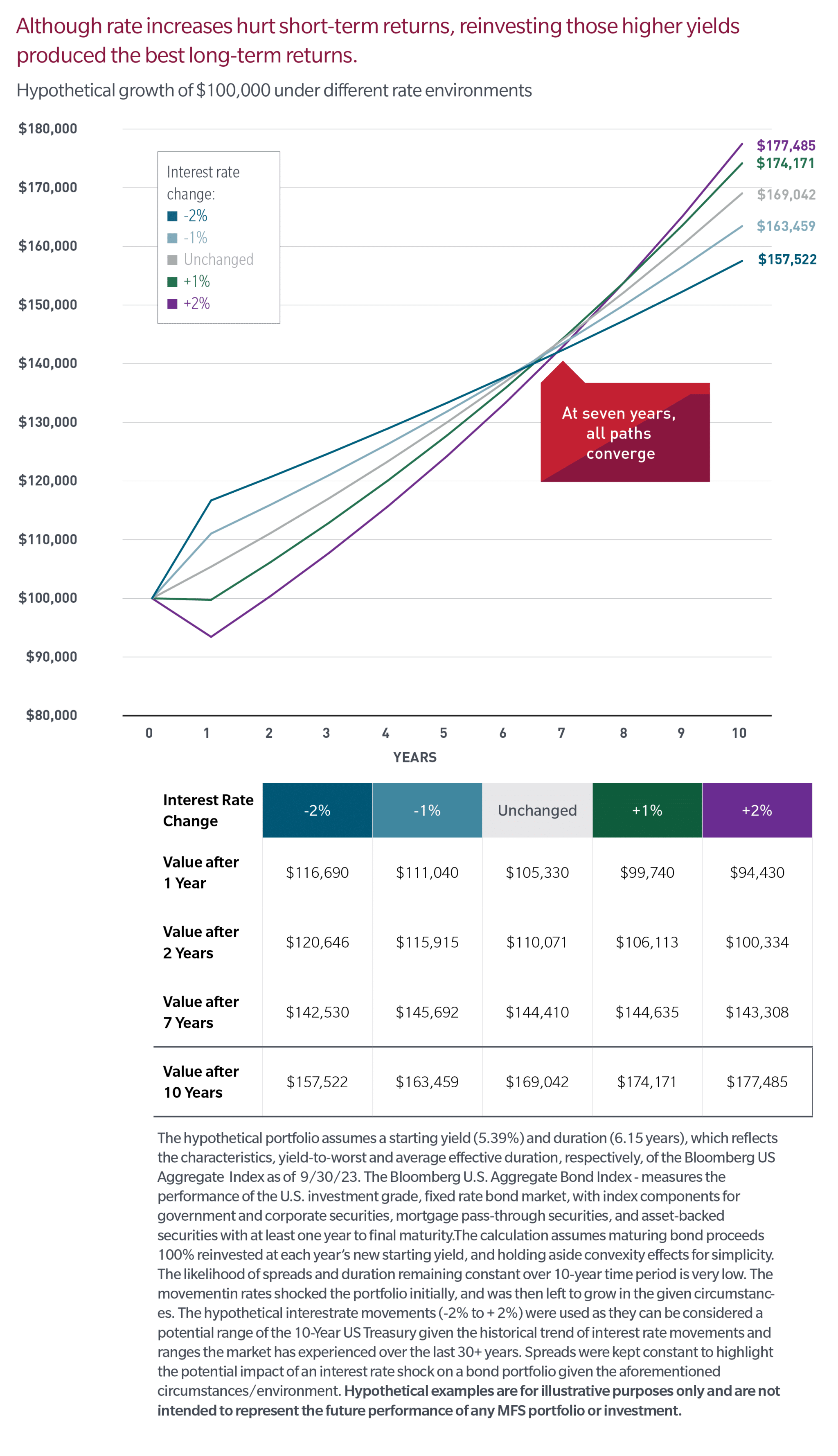

Higher, steady or lower? It is easy to get caught up in the drama of interest rate changes, and while moving to the sidelines may relieve some worries, you could also miss out on the potential long-term benefits. While the initial interest rate increases hurt short-term returns, today’s higher interest rates may increase a bond portfolio’s overall return over time. This is because money from coupons and maturing bonds can be reinvested into new bonds with higher yields. In the chart below, we show five hypothetical trajectories that a bond portfolio could follow after a move in rates based on the hypothetical performance of a $100,000 fixed income investment over a 10-year period.

Key takeaways

Focus on the long view

As the rate hiking cycle winds down, it’s natural to wonder about the direction of rates. But as you can see in the illustration, the higher interest payments can potentially benefit performance — if you reinvest maturing bond proceeds.

Consider the unique nature of bond strategies

Although returns over the short term may be adversely affected by periods of rising rates, those losses could be offset by reinvesting maturing bonds at higher rates.

Keep in mind the role bond strategies play

Regardless of the rate environment, having an appropriate allocation to bonds rather than an all-equity portfolio may help reduce portfolio volatility and help manage downside losses over time.

Investments in debt instruments may decline in value as the result of, or perception of, declines in the credit quality of the issuer, borrower, counterparty, or other entity responsible for payment, underlying collateral, or changes in economic, political, issuer- specific, or other conditions. Certain types of debt instruments can be more sensitive to these factors and therefore more volatile. In addition, debt instruments entail interest rate risk (as interest rates rise, prices usually fall). Therefore, the portfolio’s value may decline during rising rates.

Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries.

Distributed by: U.S. – MFS Investment Management

Source: Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg neither approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MFSP_RISING_FLY_3_24 40951.6