Alicia Munnell wants to take a wrecking ball to the tax preferences that are a defining feature of the retirement savings system — a system she says primarily benefits America’s wealthy.

The deferral of taxes on 401(k) and IRA accounts is intended to encourage increased retirement savings but has failed to accomplish that goal, says the former Clinton administration assistant secretary of the Treasury for economic policy.

Rather, it provides a windfall tax shelter for the top quintile of America’s earners while costing the federal government huge sums in lost taxes, according to Munnell, now director of the Center for Retirement Research at Boston College. That tax loss was about $185 billion in 2020, equal to approximately 0.9% of gross domestic product, according to a report from the Center for Retirement Research.

The report, “The Case for Using Subsidies for Retirement Plans to Fix Social Security,” was co-authored by Munnell and Andrew Biggs, a senior fellow at the American Enterprise Institute.

The billions that the government would save by ending retirement savings tax preferences could be put toward an urgent need — rescuing Social Security, maintain the authors.

Social Security’s combined trust funds are projected to run out around 2035 without increased revenues. This would trigger reductions to retirement, disability and survivor benefits.

Eliminating the tax preference for defined contribution plans — by including both employee and employer contributions in the employee’s taxable earnings and taxing the returns on contributions — would increase tax revenues by $121 billion, the authors say.

Another possible approach would be to limit the amount of money that goes into a plan, they say. That could be accomplished either by restricting combined annual employee-employer contributions, or by capping the total allowed in tax-favored retirement plans.

Raising Social Security age could hurt the poor

Munnell says she opposes proposals to reduce Social Security spending by increasing the age for receiving the full benefit from 67 to 70. “If what you want to do is reduce benefits, that’s what raising the retirement age does; it’s a benefit cut,” she says, adding that it would disproportionately hurt the poor and minorities.

“If you’re white and well educated, you can easily work past 67. But if you’re nonwhite, Black, Hispanic, and you have low levels of education, you really can’t keep working if your health is not good enough. The jobs aren’t there. And so, you end up with additional cuts in their benefit as the retirement age goes up,” Munnell says.

The Boston College report says retirement savings tax deferrals decrease tax revenues by allowing retirement assets to grow untaxed until withdrawal.

Additionally, the payroll tax that funds Social Security and Medicare takes a hit, the authors note, because in defined contribution plans, employee contributions are taxed as earnings, but employer contributions are not.

Tax breaks fail to boost retirement savings

The authors’ core argument is that retirement savings tax breaks don’t do what they’re supposed to do — increase retirement savings. They say U.S. data on the subject is scarce, but a Danish study found that such tax deferrals have little effect on people’s retirement savings rates.

That conclusion goes directly against recent U.S. government efforts to bolster the retirement system, notably the Secure 2.0 Act of 2022. Among its features, Secure 2.0 increases catch-up limits for those aged 60 to 63 and pushes back the age which retirees must start taking required minimum distributions from retirement accounts.

Far from helping the poor and middle class, these measures primarily benefit the wealthy, the authors say. They cite Vanguard data that only 16% of plan participants took advantage of the catch-up feature and these were overwhelmingly high earners.

In Munnell’s view, the provisions in Secure 2.0 are the “result of lobbying efforts for high-net-worth clients.”

“And I just can’t see any gains for society by providing more and more savings to the top quintile of the earnings distribution,” she says.

Political hot potato or bipartisan solution?

Despite the political support for tax breaks demonstrated by Secure 2.0, Munnell says the report’s findings and recommendations shouldn’t be controversial.

“I think that people have had the view that these incentives aren’t very effective for a long time. And it seems like a moment in history,” she says, referring to the possibility of reform.

Regarding the potential for political controversy, she notes that her co-author, Biggs, is with the conservative-leaning American Enterprise Institute. The two have clashed on policy issues including privatizing Social Security, how to calculate replacement rates, and whether state and local workers are overpaid.

But not on the proposal to eliminate retirement savings tax preferences to rescue Social Security.

“We were not always on the same side. But on this issue, our thoughts are aligned, and that should make people just stop and think,” Munnell says. “Not necessarily that we want to scrap the whole thing, but maybe it’s time to think hard about the money we’re spending there.”

The authors say their plan could gain bipartisan support. “Reallocating the proceeds from eliminating or reducing the retirement tax expenditure to Social Security could help Democrats and Republicans bridge the decades-long divide over whether to maintain Social Security’s solvency by raising taxes or reducing benefits,” they write.

Downside of ending retirement savings tax benefits

However, Munnell concedes that their plan would have a negative effect on the defined contribution retirement savings system.

“It definitely makes it less attractive to employers to actually do something for beneficiaries,” she says. “Because they can get away with paying their employees less, to the extent that there’s a portion of compensation that is treated favorably.”

“So yes, it’s silly to say it wouldn’t have any effect at all. The question is, what would we end up with?”

If removing retirement savings tax preferences would make the 401(k) system less attractive, the authors say, the government could mandate that businesses provide retirement savings coverage. They note that the United Kingdom requires all private-sector employers to auto-enroll workers in a retirement plan. An employer can either adopt their own plan or use the National Employment Savings Trust (NEST), a defined contribution plan run by a public corporation, they say.

But Munnell maintains the 401(k) system is “fairly well entrenched.”

The report’s authors say that defined contribution plans help employers attract and retain high-quality workers. Employer-sponsored plans are also attractive for employees because they have cost and convenience advantages over do-it-yourself IRA plans, they say.

Top quintile is the current system’s big winner

The biggest beneficiaries of retirement savings tax preferences are high-income individuals, Munnell and Biggs write.

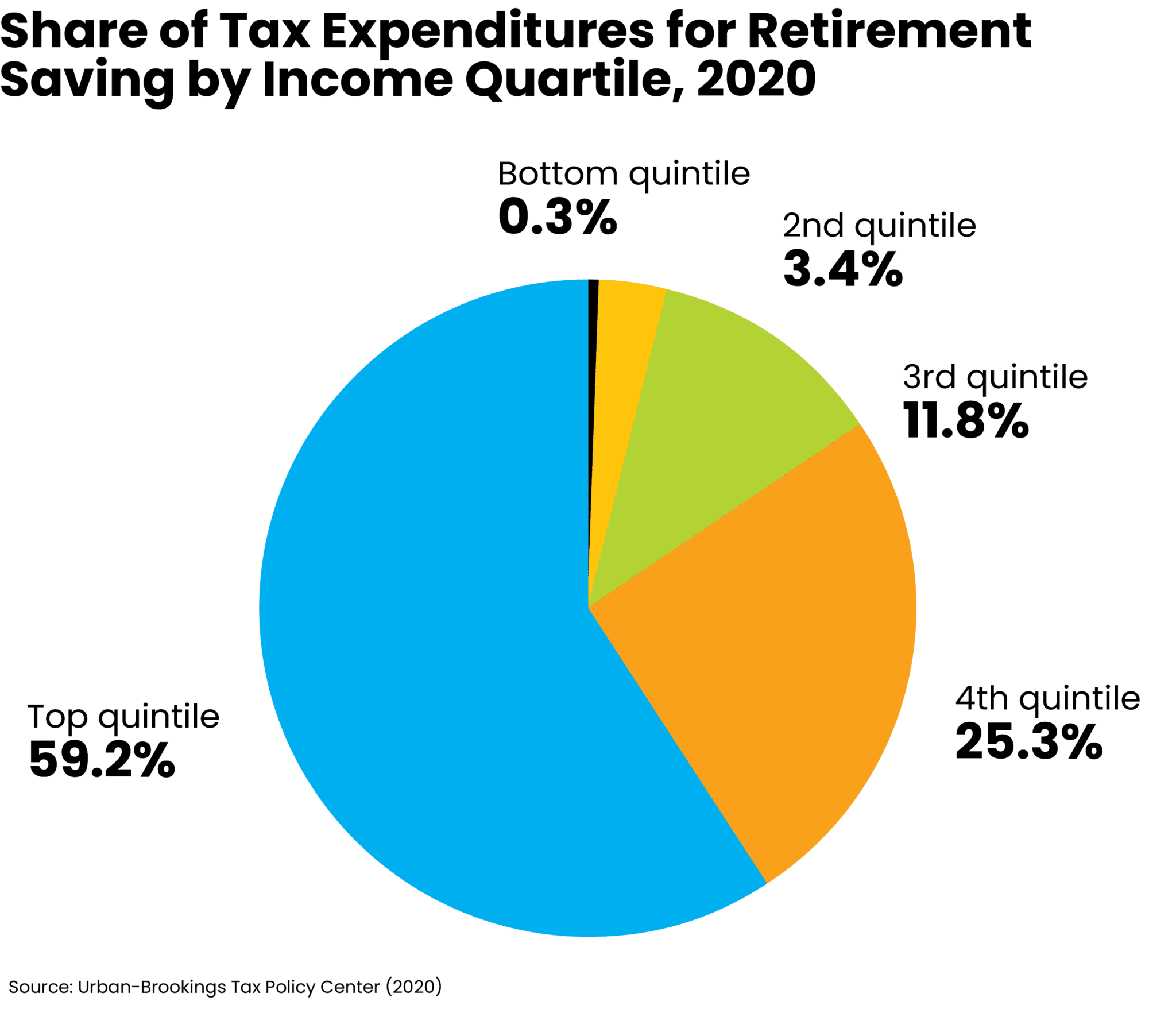

They cite simulations by the Urban-Brookings Tax Policy Center suggesting that 59% of tax expenditures for retirement saving flows to the top quintile of the income distribution. The bottom quintile gets 0.3%, according to the report.

“For a lot of lower-paid workers … these tax incentives don’t make any difference at all, really, because they don’t pay significant taxes,” Munnell says.

If tax preferences were removed from retirement savings, the wealthy would simply shift their investments elsewhere, the authors say.

“And so, if we’re convinced that those people would save on their own, then I’m not worried about them,” Munnell says of wealthy Americans. “I would like all workers to have a second tier of retirement income.

“I’m not trying to say something mean to the top quintile,” Munnell says. “I’m trying to say, let’s use our resources in a way that helps everybody more equitably.”

In a four-decade career in journalism, Ed Prince has served as an editor with many of New Jersey’s leading newspapers, including the Star-Ledger, Asbury Park Press and Home News Tribune.