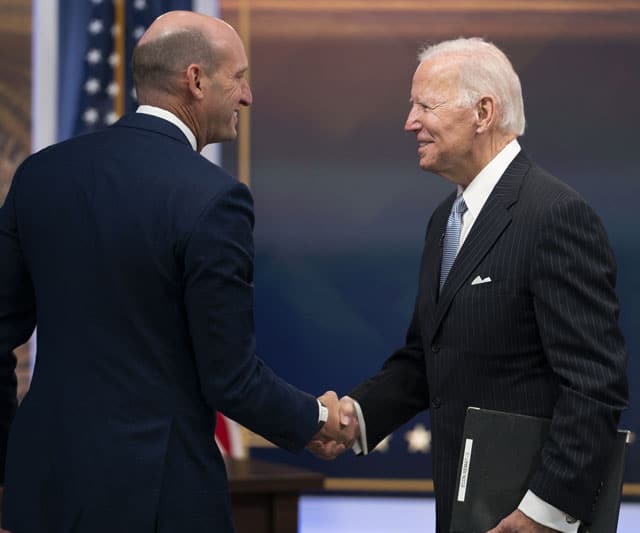

In the hours before delivering his State of the Union speech in March, President Joe Biden called the CEOs of General Motors and Cisco Systems to ask their advice on the state of the U.S. economy and share how he planned to talk about it.

Then he rode to Capitol Hill and, in his address, promised to raise the rate on a new minimum tax his administration has levied on big companies “so every big corporation finally begins to pay their fair share.”

“I also want to end tax breaks for Big Pharma, Big Oil, private jets, massive executive pay,” Biden continued, adding: “End it now.”

The sequence epitomizes Biden’s alternatively cozy and combative relationship with U.S. business leaders, which has rippled through the national economy, federal policy and now the 2024 campaign for the White House.

The president has both courted and pilloried corporate America as he seeks reelection this fall. Corporate leaders have enjoyed record profits on his watch and an open channel with his administration, but they have bristled at some of his biggest policy decisions.

There is a certain symbiosis with corporate leaders in much of Biden’s economic agenda. His industrial policy initiatives depend heavily on corporate tax incentives, which he champions at ribbon-cuttings nationwide: The climate and advanced-manufacturing laws that Biden signed in 2022 feature large tax cuts for corporations that invest in the production of semiconductors, solar panels and other strategic goods. Republicans have derisively called those incentives “corporate welfare.”

Biden frequently seeks executives’ counsel on a wide variety of economic issues, including supply chain snarls, infrastructure investments and worker training. He impressed Calvin Butler, the CEO of the utility giant Exelon, in a two-hour meeting in the Oval Office with executives last fall.

“He was engaged in it, and I can tell you this,” Butler said in an interview. “At about the hour mark, they kept tapping on him to say, ‘Hey, you know, we got other things to do.’ But he wanted to keep it going. He wanted to keep talking.”

Raising Corporate Taxes, Intervention

As he seeks reelection, though, Biden has leaned heavily into populist attacks on the executives and companies he has engaged. He loves to talk about raising corporate taxes. He has also taken to blaming big companies, sometimes by name, for raising prices on some consumer staples. He blasts others for shrinking portions of snack foods, like candy bars, without cutting their prices.

Biden has also brought to office an economic philosophy that relies heavily on federal government intervention in private markets. That includes investments in infrastructure and industries, which business leaders generally support.

But it also includes environmental, financial and other regulations meant to reduce risks in the marketplace. Businesses oppose those efforts, along with the administration’s aggressive antitrust enforcement and other initiatives meant to stimulate competition.

As a result, Biden’s relationship with corporate America “is a complicated one,” said Neil Bradley, the executive vice president and chief policy officer at the U.S. Chamber of Commerce, a large business lobbying group in Washington.

Biden and his economic team have been open and thorough in their outreach to business groups, Bradley said, but frustrating in their policy choices. Chamber officials calculate that federal agencies under Biden have issued about twice as many regulations considered “economically significant” — currently defined as carrying at least a $200 million annual effect on the economy — as they did under President Donald Trump.

Trump: Uncertainty But Lighter Regulation

It is a contrast with Trump, whose administration employed less consistent outreach and careened chaotically from crisis to crisis. Bradley said executives were torn on which combination they preferred.

“You can look at a Trump administration with a lot more uncertainty, but directionally, the regulatory effort was moving to lighten the regulatory costs,” he said. “Here in the Biden administration, we have a pretty good idea where they’re going to go — it’s just how crushing is it going to be in terms of the regulatory level? And so, interestingly, there’s a lot of people saying, ‘The chaos is better.’”

Biden speaks regularly with leaders from large corporations and small businesses, and he has visited dozens of companies while in office. Executives who have spoken with the president and his aides say they listen earnestly to companies’ concerns, even when Biden and his team make clear that they disagree on the policy matter at hand.

Butler said he had urged Biden at the White House to move faster to clear permitting issues and other hurdles to the building out of new-energy infrastructure. Mark Cuban, the famed investor and a founder of Cost Plus Drugs, said in an email that his conversations with Biden largely focused on health care, including what he called the “great job” that the president had done in getting Medicare to negotiate lower prescription drug prices.

Brad Smith, the president of Microsoft, said in an interview that he had talked with Biden about carrying out his infrastructure bill and the CHIPS and Science Act, along with regulation of artificial intelligence. He praised Biden’s efforts to strengthen cybersecurity, saying he has “done more in his presidency than any president ever” on that issue.

Biden’s staff, Smith added, “has a breadth of expertise that is being applied at a deep level.” Under Trump, “the staff was leaner,” he said. “There weren’t as many in a lot of key jobs.”

Climate Agenda Criticisms

Other executives have criticized Biden’s policies, all or in part. Oil and gas executives have denounced an administration pause on the permitting of new natural gas export terminals. Jamie Dimon, the CEO of JPMorgan Chase, called Biden’s climate law and other green energy initiatives “inflationary” in an interview with CNBC this year.

Ken Griffin, the founder of the financial firm Citadel and a major Republican donor, swiped at Biden’s economic pitch in a Bloomberg interview in November. “Whoever told him to run on Bidenomics has no idea how to read an economics textbook,” Griffin said.

The Biden outreach to executives is similar to the approach employed by President Barack Obama and his team, according to business leaders and administration officials who also served under Obama.

But Biden differs from Obama — and Trump — in several respects. Executives who have spoken with him say the president makes clear in conversations that he is a “labor guy,” who measures economic success in part by the creation of well-paying union jobs. He has embraced robust federal scrutiny of mergers and other antitrust issues to a degree that even Obama did not.

He also has deeper policy entanglements with corporate behavior. Biden’s climate agenda blends corporate tax sweeteners for domestic production with a strict wave of regulations meant to quickly reduce fossil-fuel emissions. In some cases, agencies under Biden have softened some regulatory proposals in their final form — explicitly, administration officials say, to address corporate concerns.

Lael Brainard, who leads the White House National Economic Council, said in an interview that the president’s targeted corporate tax breaks were a departure from a Republican philosophy that pushed “across-the-board tax breaks for businesses, regardless of whether they were making investments that are good for America, generate jobs, help with a clean energy transition.”

Democratic pollsters are encouraging Biden to amplify that message in his reelection campaign. They want him to emphasize his plans to raise taxes for big companies while calling out firms for raising prices to pad profits and saddling customers with “junk fees” for things such as concert tickets. Their data suggest that corporate taxation is a key vulnerability this fall for Trump, who cut corporate tax rates while in office and is set to face Biden in a 2020 rematch.

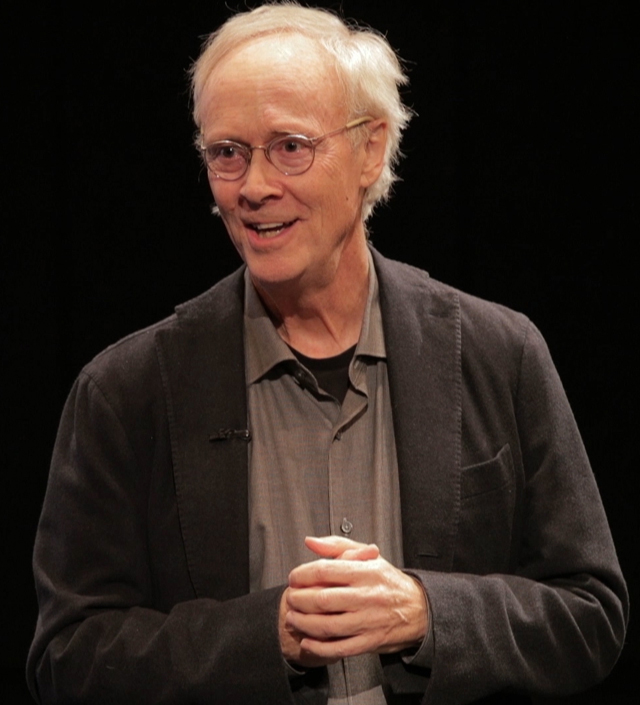

Voters “want to feel the president is on their side against people they think are squeezing them,” said Evan Roth Smith, the lead pollster at the Democratic group Blueprint. “Voters have no sympathy for big companies right now,” he added.

Bradley said many executives bristled at that language, and in particular at Biden’s practice of calling out companies by name for raising prices or shrinking portions. But some executives dismiss or downplay Biden’s tax proposals — and repeated calls for companies to pay their “fair share” — as campaign bluster.

“Recognizing how D.C. works, and that we’re in a political season, I tend not to get too high or too low on any of that,” Butler said.

c.2024 The New York Times Company. This article originally appeared in The New York Times.