Time and time again, we hear that the best way to get client introductions is to ask for referrals from existing clients, friend and family. It sounds easy enough. But the truth is, advisors often struggle with this. You may be one of them. Many advisors and their clients fear providing or seeking introductions to prospective clients.

A study published last year by the Financial Planning Association and Janus Henderson Investors found 43% of advisors are worried about seeming pushy or overly sales-oriented when trying to grow their businesses. “This fear often prevents them from proactively expanding their client base and increasing their assets under management,” says the FPA. As a result, “most advisors had less than stellar new client growth.”

Duncan MacPherson, CEO of Pareto Systems, coaching for financial advisors, has posted on LinkedIn, “Most of your clients don’t ‘go there’ because they are unclear of how it looks to get involved in someone’s life and potentially put their own reputation on the line. They are undermined by a subconscious ‘no good deed goes unpunished’ mindset, so they don’t get involved, even when the opportunity is presented. It’s not that they’re unconvinced or unmotivated, there is just some uncertainty about referring, so they don’t.”

We hear this, read this, and believe it.

One well known and competent researcher in the area of client satisfaction and introductions (or referrals), Julia Littlechild, stated that 55% of the financial advisory clients surveyed “didn’t know anyone who they thought needed an advisor.” Perhaps few of your clients walk around thinking about others who might need a financial advisor. But if we asked clients, in a non-pushy way if they knew anyone, might the result improve? Interestingly, Littlechild’s research stated that only 18% of clients said that making referrals made them feel uncomfortable. Another 13% said they weren’t sure who they should refer (or introduce) you to. This can also be a context issue, so let’s discuss a potential context.

Building Feedback into Your Agenda

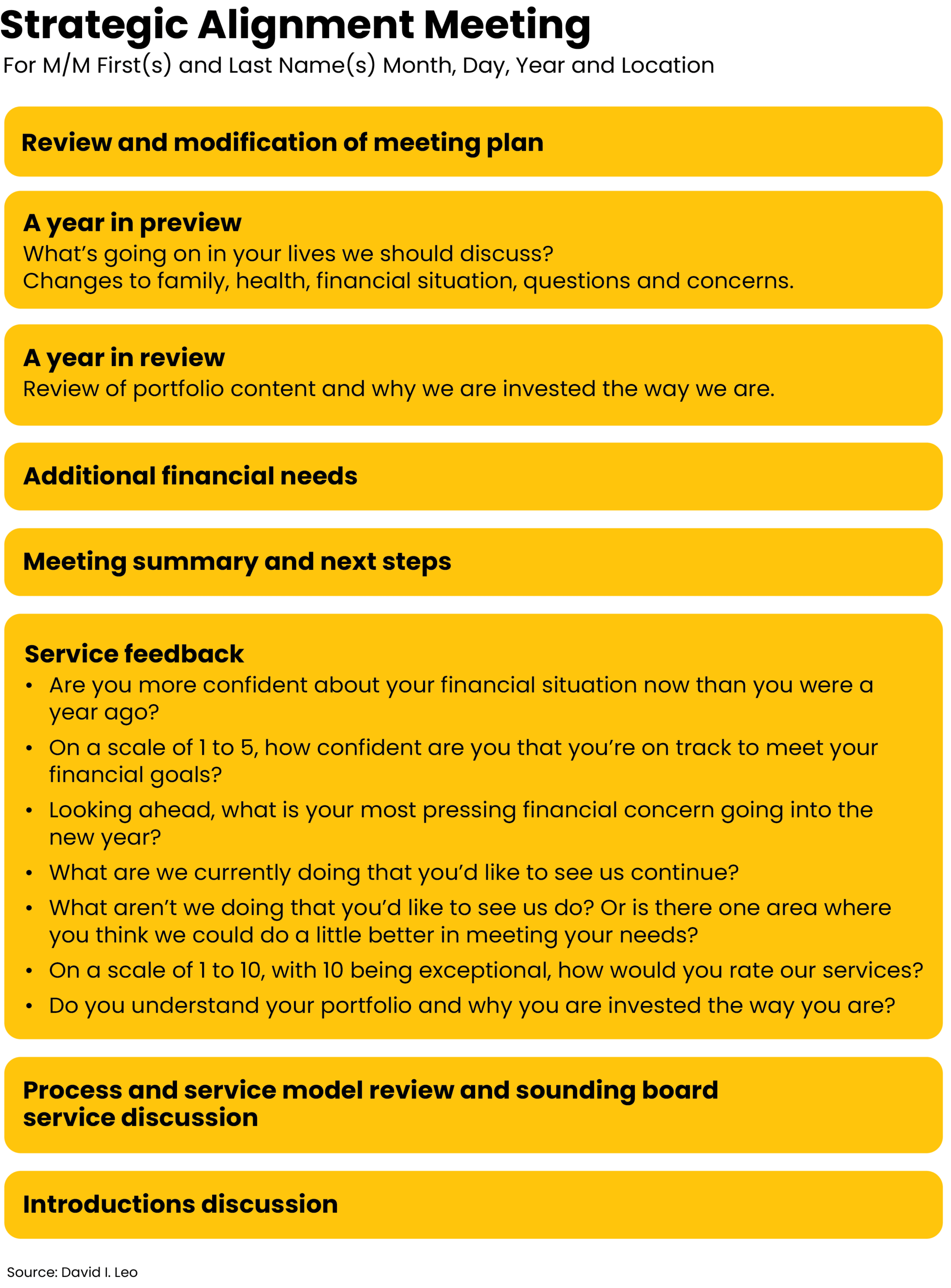

From my work, the “best” way to approach introductions is to make it a part of your regular and structured client review meetings. Make it a standard part of your written agenda. Here’s a condensed version of my agenda:

The only part of the agenda condensed was the top part, above the “service feedback” bullet. After your meeting summary, you would say to your client, “As we have previously discussed, I’d like to get your feedback on our service so we can make sure we are delivering on our promises and fulfilling your needs.” You would go through the questions, noting the answers and of course being prepared to respond and to make necessary changes to your deliverables, processes, or anything else appropriate.

If there have been negatives, it would be illogical to seek introductions so you would focus on addressing the issues your client raised.

Sounding-board Script

If all has been positive to this point you can move into the next part of the agenda: reviewing your services and having the “sounding-board service discussion.”

Here’s the script and approach you can use:

“Before we conclude our meeting, I’d like to make another service offer to you. As you can imagine, I’ve been speaking to many clients recently, many of whom have friends and family members who are a bit unsettled by market volatility, the economy, inflation, their ability to retire, healthcare costs, and more. They may be looking to the future with apprehension rather than anticipation.”

“I’m telling you this because I want to remind you that, as a value-added service, I will gladly be a sounding board for anyone who is looking for a voice of reason. And bear in mind, they do not need to be or become a client to take advantage of this service. If they’re important to you, they’re important to me and I will gladly devote time regardless of their financial position.”

It’s imperative that you sincerely offer help and do not come off sounding as though you are seeking. The other thing to recognize is that while you can use the same basic agenda for your future meetings, it doesn’t make sense to use the same script. You can however use a modified version of the script such as, “We’ve previously discussed the fact that I am open to speaking to any of your friends or family that are concerned about their financial futures.” This should be enough of a reminder your client that you are there to help and have time for new clients.

This approach does not seek referrals or client introductions. You are not asking for anything; you are making an offer to help. You do have to be prepared to offer help. And should these people wish to become clients but do not fit your business model, you should be prepared to offer them an alternative.

David Leo is founder of Street Smart Research Group LLC. He is an author, speaker, coach, consultant, and trainer to financial professionals. David has worked with the financial services industry for decades, originally as a consultant with IBM and then with UBS/Paine Webber before starting his own firm. If you would like more information about his services, contact him at David@CoachDavidLeo.com or visit www.CoachDavidLeo.com.