The S&P 500 is poised to finish higher for 2023, but that does not tell the whole story. A handful of the largest stocks in the index have delivered the lion’s share of the gains — which is not particularly healthy for markets or for clients looking to manage risk.

The Fed’s “higher for longer” message on interest rates is creating continued anxiety. When will inflation be under control? How many more interest rate increases are coming down the pike? Will the U.S. economy move into recession? If so, when?

Now let’s consider uncertainty in the rest of the world. The surprise attack by Hamas on Israel has already left thousands of people dead. In response, Israel appears committed to a war that could last longer than most expect and is already affecting the United States. This is on top of the massively destructive war in Ukraine that is continuing. These are just a few situations at the top of my mind.

Over the past two-plus years, even before the Federal Reserve made its first interest rate move, we’ve been discussing uncertainty and what to do about it. In November 2022, I wrote an article about the record-breaking sales of fixed annuities and how they can help mitigate the dramatic ups and downs of the financial market that are largely being driven by interest rate hikes. Since then, fixed annuities have continued to break records.

I hope we can all agree that today seems very different. There’s an unmistakable air of unpredictability and a noticeable increase in the speed of change. So, what do we tell consumers to do?

Here are a couple of options. We can tell clients to park their money in a 6-month Certificate of Deposit and wait. This option is based on a prediction that interest rates will go higher. In my view, this option requires a working crystal ball and a belief that it’s possible to determine world events. This is an even more dangerous belief than the idea that anyone can time the markets.

Let’s return for a minute to the possibility of a recession in the U.S. If it happens, the Fed may start loosening fiscal policy. Is it possible to time the crest of interest rate increases?

It’s doubtful.

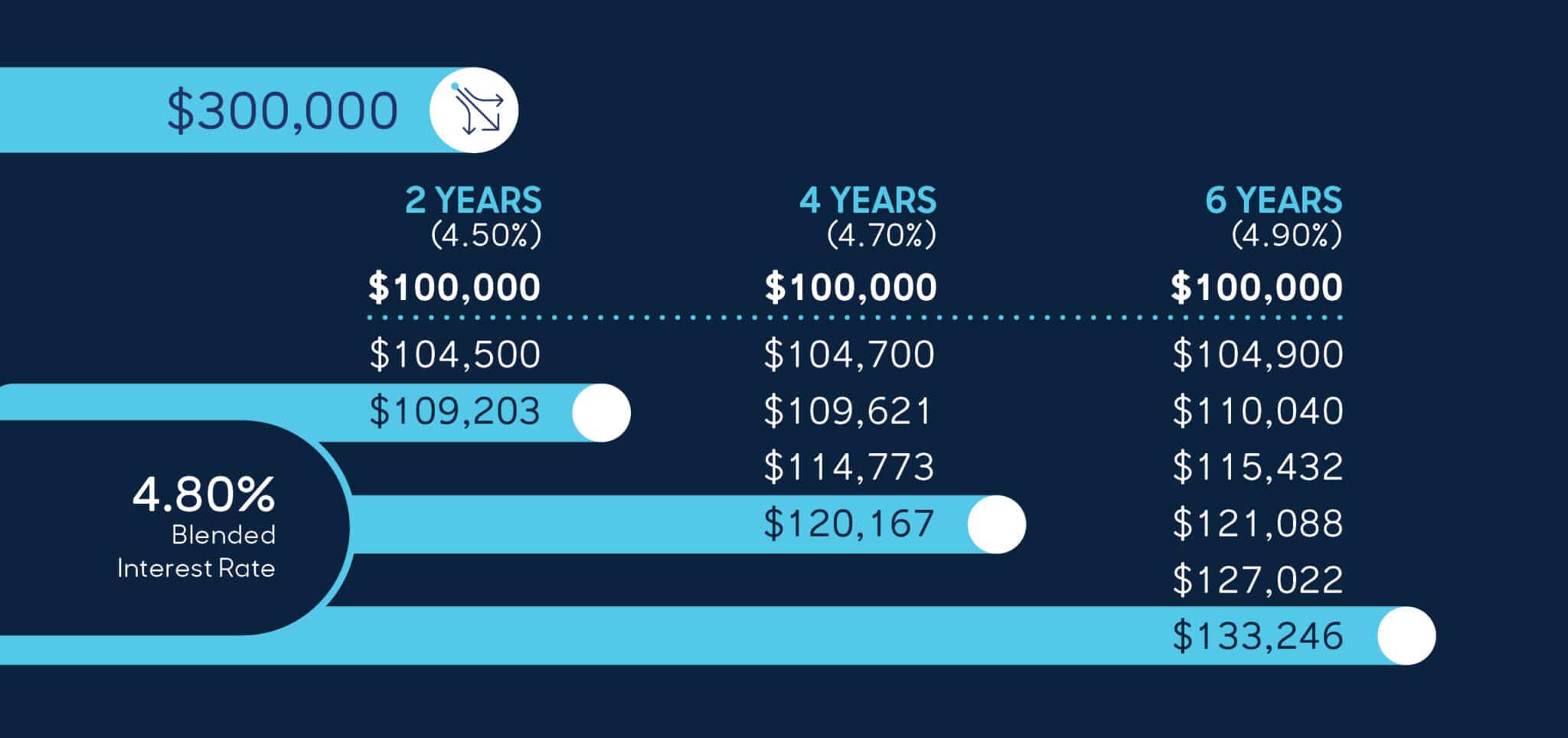

Here’s another option. Let’s say a consumer has $300,000 in cash. A laddering strategy — with 2-, 4-, and 6-year durations can help the client spread out the interest rate risk and eliminate the risk of trying to time the market. By using an annuity, they are also deferring taxes on non-qualified accounts, leaving that interest earned to benefit from compounding. Let’s use the MassMutual Premier Voyage Product as an example of laddering.

The only certainty appears to be that we have a lot of uncertainties to contend with.

If we do enter a recession, when will the Fed begin to lower interest rates? I believe our best course of action during these times is to avoid predicting and help our clients prepare.

FOR FINANCIAL PROFESSIONALS. NOT FOR USE WITH THE PUBLIC.

This material does not constitute a recommendation to engage in or refrain from a particular course of action. The information within has not been tailored for any individual. The information provided is not written or intended as specific tax or legal advice. MassMutual, its subsidiaries, employees and representatives are not authorized to give tax or legal advice. Individuals are encouraged to seek advice from their own tax or legal counsel.

Any guarantees explicitly referenced herein are based on the claims-paying ability of the issuing insurance company.

MassMutual Premier VoyageSM (Contract Form #FPFA22-PV, and ICC22-FPFA-PV in some states including NC) is a fixed deferred annuity contract issued by Massachusetts Mutual Life Insurance Company, Springfield, MA 01111.

The product and/or certain features may not be available in all states or with all distributors.

© 2023 Massachusetts Mutual Life Insurance Company (MassMutual), Springfield, MA 01111-0001. All rights reserved. www.massmutual.com.

MM202611-307278