There will always be a need for financial professionals to help clients plan for retirement. Here’s one reason why that statement may be truer today than in times past. According to the National Institute of Health, people are living longer. That means their retirement years may represent up to one-third of their lives. Having sufficient retirement income to last 30-35 years requires some disciplined planning. And this type of planning requires an effective retirement income planning tool.

People often ask when they should start planning. There are those who urge starting in the mid-20s — with the first significant paycheck. It’s true that the earlier you start, the more you accumulate. But this isn’t planning, it’s saving. And not everyone can start saving for retirement when there are so many competing demands — paying student loan debt, saving for a down payment on a mortgage, perhaps starting a family.

Mapping out a retirement income plan is much more relevant and meaningful for people ages 45 to 55. Some of the early obligations may have been paid off. It’s likely expenses more closely resemble retirement expenses, with salaries on the rise and perhaps starting to peak. At this point, people can start getting serious about retirement income planning by working with a financial professional.

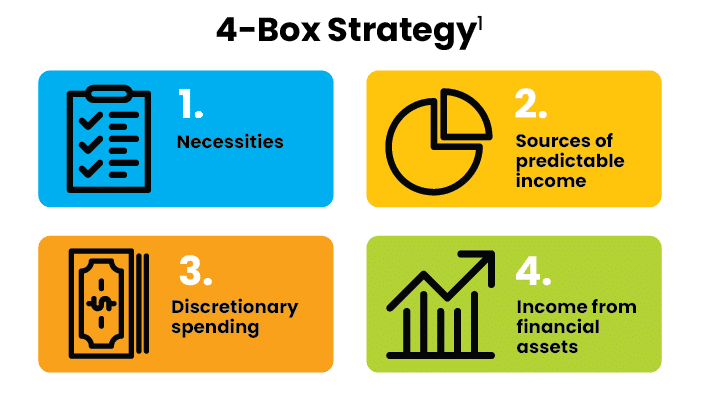

The retirement income planning tool I’m referring to is the 4-Box Strategy. This simple, commonsense approach gets clients focused on expenses — both necessary and discretionary, and two types of income — predictable and income generated from assets, as you can see from the below diagram.

Let’s start with Box 1: the necessities — housing, food, health care, transportation — those things necessary to maintain the lifestyle to which a person has become accustomed. It’s true that clients will have different definitions of what is considered necessary. Obviously, the definition could be broader than these staple lifestyle i terms I’ve called out. Regardless of a client’s definition, necessities should be covered by Box 2: predictable income sources — Social Security, pensions, and fixed annuities. Clients will need to know the Social Security benefit available to them at age 67, full retirement age. If a person waits until age 70, the maximum benefit in is $3,627, thanks to an 8.7% cost of living adjustment in 2023, the largest increase in 40 years. Other good news is inflation is starting to decrease, finally yielding to the Federal Reserve’s series of 75 basis point interest rate hikes in 2022.

Let’s start with Box 1: the necessities — housing, food, health care, transportation — those things necessary to maintain the lifestyle to which a person has become accustomed. It’s true that clients will have different definitions of what is considered necessary. Obviously, the definition could be broader than these staple lifestyle i terms I’ve called out. Regardless of a client’s definition, necessities should be covered by Box 2: predictable income sources — Social Security, pensions, and fixed annuities. Clients will need to know the Social Security benefit available to them at age 67, full retirement age. If a person waits until age 70, the maximum benefit in is $3,627, thanks to an 8.7% cost of living adjustment in 2023, the largest increase in 40 years. Other good news is inflation is starting to decrease, finally yielding to the Federal Reserve’s series of 75 basis point interest rate hikes in 2022.

How about other sources like pensions? Currently, only 31% of people who are heading into retirement will have access to a pension. Annuities represent another source of lifetime guaranteed income. Income annuities can help strengthen the foundation of a client’s predictable retirement income, making it more likely to cover necessities.

Next stop is Box 3: discretionary expenses. These are the activities and experiences that make life fulfilling. These expenses include a wide range of interests and activities — from world travel, trips to see family, country club memberships, boating, fishing to items on one’s proverbial bucket list. If you do not know your clients’ interests, this is a great discussion topic. What do you most enjoy doing? Whatever items are on a client’s discretionary list should be covered by Box 4: income generated by financial assets e.g., stocks, bonds, cash, mutual funds, among others.

As we all know, 2022 was a particularly rough year for stocks and bonds. At the end of the year, global stocks and bonds lost more than $30 trillion in 2022 according to the Financial Times. In the U.S., the S&P 500 lost 19%, Nasdaq 33%, and the Dow was down 8.78%. The Total Bond Index, which tracks U.S. investment grade bonds, lost more than 13% in 2022.

Retirement income planning may seem a lot more challenging after a year like 2022. The first question you can ask clients to think about is, “How long will it be until you begin

to tap into your investment earnings and principal? Is it 10 years or less? More than 10?” Clients will likely ask, “How long will it take to recover the losses from 2022?” Followed by, “Are we looking at a recession in 2023?” Clients need to understand the composition of their portfolio, how much is invested stocks versus bonds. They need to assess whether they are comfortable with the level of risk exposure. Is it time to introduce more low-risk, fixed-income investments into the portfolio?

Regardless of market performance, if a client’s necessary expenses are covered by predictable income sources it can bring an element of “peace of mind” to a retirement income plan, knowing the basics are covered.

The 4-Box-Strategy is a great planning tool that is easy to use and understand. Using

it helps you engage in dialogue with your clients on what matters to them and leads to a discussion regarding evaluating potential solutions. Clients are counting on their advisors to help them stay the course toward a long, rewarding and fully funded retirement.

One tool that can help is the 4-Box Strategy.

1 © 2023 Farrell Dolan Associates. The 4 Box Strategy® is used by MassMutual with the express written consent of Farrell Dolan Associates.

FOR FINANCIAL PROFESSIONAL USE ONLY. NOT FOR USE WITH THE PUBLIC.

This material does not constitute a recommendation to engage in or refrain from a particular course of action. The information within has not been tailored for any individual. The information provided is not written or intended as specific tax or legal advice. MassMutual, its subsidiaries, employees and representatives are not authorized to give tax or legal advice. Individuals are encouraged to seek advice from their own tax or legal counsel.

© 2023 Massachusetts Mutual Life Insurance Company (MassMutual®), 1295 State Street, Springfield, MA 01111-0001. All rights reserved. www.MassMutual.com.

SDP5035 0223 MM202602-304493