The work-from-home transition thrust into overdrive by the pandemic has caused at least one leading real estate portfolio manager to shift gears.

“The long-term impact on space demand caused by the work-from-home model, which COVID accelerated, is largely unknown,” said Richard Kimble, portfolio manager of the Nuveen Global Cities REIT (GCREIT), in a June 22 release. “While there are positive signals for demand for the office sector, we have increased our allocation to medical office, life science, and R&D because we believe these alternative office uses are much more insulated from work-from-home solutions.”

At the time of Kimble’s comments, GCREIT also announced it had purchased two properties. One is 10455 Pacific Center Court, a 92,000-square-foot R&D office in the Sorrento Mesa submarket of San Diego, Calif. The other is Hillcroft Medical Center, a 41,000-square-foot medical office building in the fast-growing Houston suburb of Sugar Land, Texas, and within 1.5 miles of three regional hospitals.

Nuveen noted the healthcare real estate sector has been a steady performer through the COVID-19 pandemic. It added the sector is not subject to work-from-home risks given the need for in-person interaction and specialized use of the tenants.

“The underlying healthcare and R&D industries have positive fundamentals that continue to require additional specialized office space,” Nuveen said. “GCREIT expects these alternative office sectors to continue to outperform.”

Self-Storage Alternative

On its website, GCREIT notes it is also venturing into another sector: self-storage.

According to the fund, “… this property type is considered a defensive property type and has ultimately outperformed traditional sectors throughout multiple real estate cycles. Going forward, self-storage is projected to continue outperforming given the sector’s favorable net operating income growth forecast and low capital expenditures relative to traditional sectors.”

In June, GCREIT closed on its first self-storage property: Palm Bay Storage in Palm Bay, Fla.

As of May 31, the fund had $2.31 billion in assets and a one-year return of 26.97%. Monthly annualized distributions to shareholders were 5.46%.

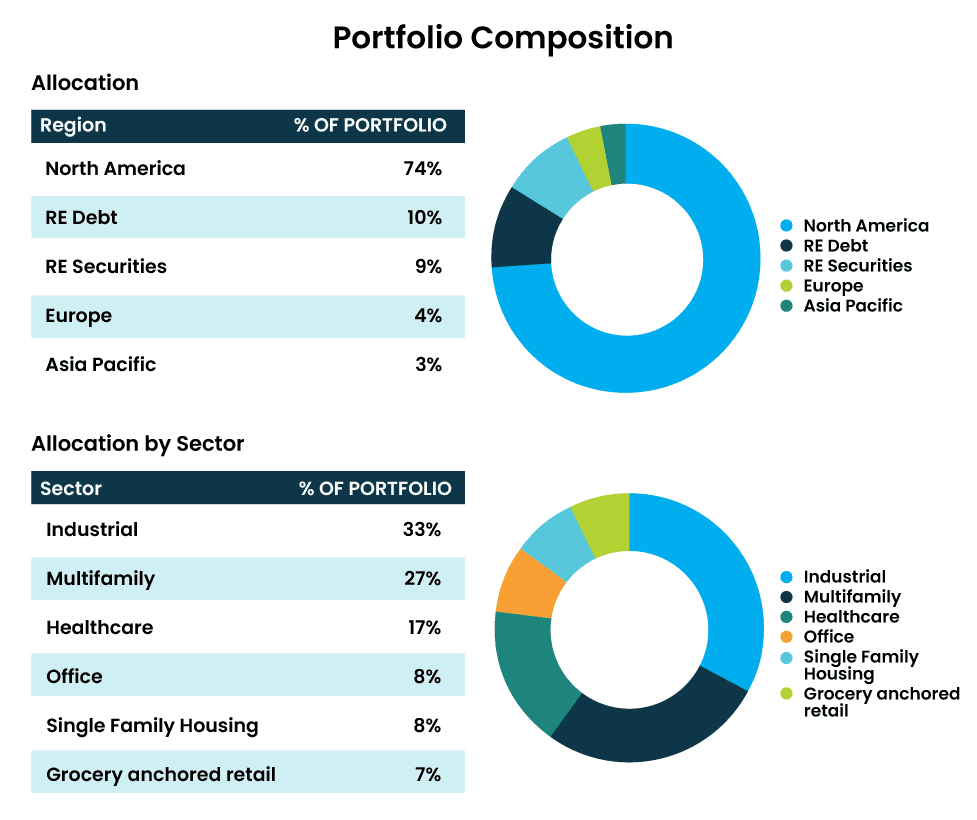

Nuveen Global Cities REIT directly owns 334 properties, including 293 single-family homes, and has exposure to 31 other properties owned by international affiliated funds in which GCREIT has made an investment. Approximately 74% of the fund’s properties are in North America. The fund’s leverage ratio was 16.28%.

The fund is affiliated with Nuveen Real Estate, one of the largest investment managers in the world with $134 billion of assets under management.