“Trump Accounts,” a provision in the House version of the “One, Big, Beautiful Bill” spending plan, are intended to help families save for their children’s futures — but they would increase the complexity of an already overburdened savings system while offering few advantages, according to an analysis by the Tax Foundation.

Under the Trump Accounts proposal, the government would make a $1,000 deposit to certain children born from 2025 through 2028, allow after-tax contributions of up to $5,000 per year, and allow the accounts to grow tax-deferred. Withdrawals for eligible expenses such as education, a first-time home purchase, or small business expenses would be taxable as the long-term capital gains.

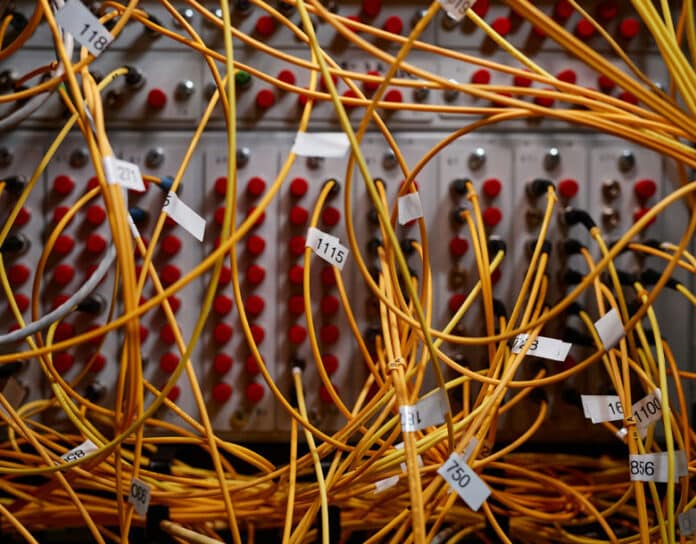

However, the Tax Foundation said in a statement that the plan would add to an overcrowded system, noting that the tax code already includes at least 11 tax-advantaged savings vehicles, each with its own rules, limitations and regulations. “The addition of the Trump Accounts would further complicate savings for taxpayers who would have to keep track of yet another account,” according to the statement.

The new accounts would further burden the Treasury Department and IRS, which already have their hands full administering the many existing savings accounts, according to the Tax Foundation.

The foundation further faulted Trump Accounts by noting that contributions would not be deductible, while qualifying withdrawals would be subject the reduced long-term capital gains tax rate, with the result that they would offer less-generous treatment than either a traditional or a Roth account. They would also be less generous than a 529 savings plan, which gives a full exemption for withdrawals used for qualifying expenses. However, Trump Accounts would have a tax advantage over a generic brokerage account by offering tax deferral, the foundation said.

Trump Accounts would recognize only three expenditures as qualifying for the long-term capital gains tax rate: college tuition or credentialing expenses, small business expenditures and first-time home purchases. Withdrawals for any other purpose would be subject to a higher tax rate.

“Proponents of Trump Accounts say they will promote saving and long-term wealth,” the Tax Foundation said. “However, the account owners would need to withdraw the full balance of the account by age 31 to avoid the money being taxed as income. This requirement is counterintuitive to encouraging truly long-term saving and wealth building.”

A Call for a Simpler “Universal” Solution

The Tax Foundation instead advocated for adoption of universal savings accounts, which it said would be a single, simple, flexible option that would permit tax-free withdrawals for any purpose.

Canada and the United Kingdom both allow universal savings accounts, which are used by more than half the adult population of each country and hold more funds than other retirement accounts. In the case of low-income individuals, balances in these savings accounts are often greater than their income, which the Tax Foundation said demonstrates robust financial security.

“If the federal government really wanted to make saving more accessible, it would replace our complicated mess of a system with universal savings accounts, not tack another restrictive and complex savings vehicle like Trump Accounts on top of it,” the Tax Foundation said.