Last week, we explored the old economic rules that falsely predicted an imminent recession. Losing those guideposts has complicated our efforts to craft an outlook.

But the pandemic was not the only economic cycle that defied conventional wisdom. Prior to the Global Financial Crisis (GFC) of 2008, we took comfort in the fact that house prices had never experienced a sustained loss outside of the Great Depression. The crash that followed broke another long-standing assumption.

hat not-too-distant memory has raised fear of another housing correction in the present day. High demand for space at home and easy financing drove frenetic purchase activity during the pandemic. Nationally, house price indices rose by 40% in two years. As monetary conditions tightened, the real estate market appeared primed for another crash.

Instead, house price indices in most markets have continued to appreciate moderately. In the face of lower demand and higher interest rates, how have homes remained so expensive?

Despite high prices, strong labor markets are still equipping people to buy homes. However, those potential buyers are frustrated, finding few listings and high competition when bidding.

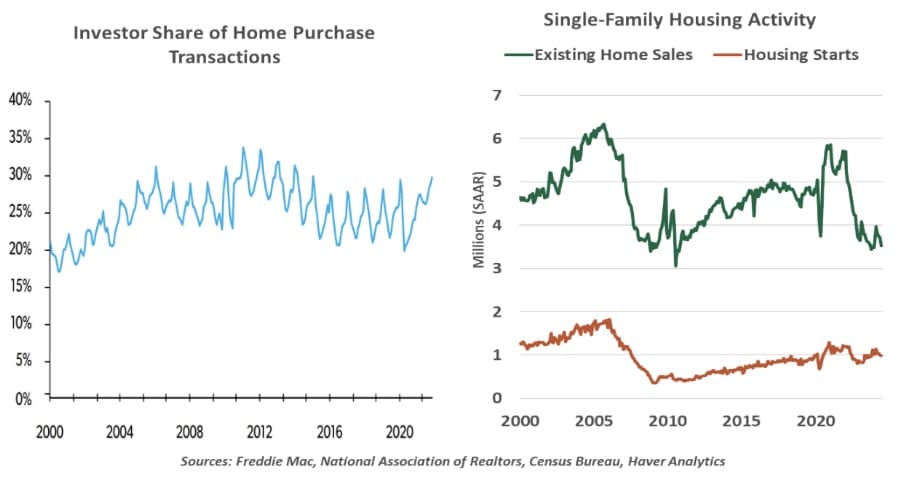

Institutional buyers have caught some blame for the shortage. Coming out of the GFC, institutional funds were raised to purchase homes out of foreclosure and rent them out, creating a new single-family rental (SFR) asset class. Those buyers remain on the market, but their role can be overstated. Freddie Mac estimated the share of home sales to investors peaked in this cycle at 28% in late 2021; of these, only 2% of purchases were to large corporate buyers. Most landlords are small stakeholders, owning 1-4 properties. And some of them are not offering conventional leases, but rather listing properties on short-term rental platforms.

Investors make their presence especially apparent at the lower end of the market. The best returns accrue to investors who start from a low cost basis. First-time home buyers targeting these entry-level properties will face more competition, often against investors (both large and small) who can promise a quick, all-cash transaction.

Fundamentally, buyers’ circumstances are difficult because supply is constrained. Current homeowners are reluctant to give up their low interest rates by upgrading to a new home. However, supply is not keeping up with demand; housing starts are holding at a rather temperate level. What’s holding back construction?

High interest rates are not only weighing on buyers. Property developers also now face higher carrying costs for their construction loans. Homes that are getting built skew toward higher-end properties that offer the greatest potential payout when the keys are handed over. Every addition to housing stock can help address the shortage, but not all buyers can step into these premium properties.

And in a market with high prevailing rates, home building is just one of many attractive investments. With more liquid asset classes offering tempting returns, lenders and investors are skeptical of locking up capital in construction projects.

Financing is not the only obstacle. Local zoning policies often limit the uses of land and prevent more dense development in established communities. Land use policies are local matters and difficult to reform broadly. Short-term rentals have come under scrutiny, sometimes prohibited by homeowners’ associations; larger cities may levy taxes or limitations on these arrangements, but more extensive restrictions are unlikely. National legislation like the stalled “End Hedge Fund Control of American Homes Act” would not significantly change demand dynamics.

Like markets for other goods and services, housing is bound by the law of supply and demand. The supply of homes is short of demand, and their prices are rising. This is one economic rule that we expect to hold.

Disclaimers

Ryan James Boyle is the Chief U.S. Economist within the Global Risk Management division of Northern Trust. In this role, Ryan is responsible for briefing clients and partners on the economy and business conditions, supporting internal stress testing and capital allocation processes, and publishing economic commentaries.

Information is not intended to be and should not be construed as an offer, solicitation, or recommendation with respect to any transaction and should not be treated as legal advice, investment advice, or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions. © 2024 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulations. For legal and regulatory information about individual market offices, visit northerntrust.com/terms-and-conditions.