Financial planners think they communicate a lot better with clients than clients think they do.

That’s the result of a new comprehensive study by researchers from the MQ Research Consortium and the Kansas State University Personal Financial Planning Program. The Financial Planning Association and Allianz Life Insurance Company of North America supported the study, done once before in 2006. It examined communication best practices and how they impact the trust and commitment clients have in their planners.

Researchers sent an online survey to financial planners from May 25 through June 15, 2021, that produced a sample of 352 usable surveys. Financial planners participating in the research distributed a survey to their clients. That effort resulted in 429 usable client surveys.

Client Anxiety

In particular, the study found that planners greatly underestimated clients’ financial anxiety. On average, planners thought financial anxiety affected about half of their clients (49%). But nearly three in four clients (71%) reported experiencing financial anxiety at least half of the time.

Clients’ financial anxiety decreased their rating of planners’ ability to deliver services related to communication topics, the study said.

“Because financial planning is a highly individualized process, a primary goal for financial planners must be conducting a qualitative data gathering process that allows and encourages clients to communicate their values, priorities, hopes and concerns,” said Carol Anderson, president of the MQ Research & Education, in a press release. “This study confirms that financial planners who make this type of inquiry a priority will be richly rewarded with successful and satisfying long-term client relationships.”

In fact, the research showed that planners consistently gave themselves much higher marks than clients did in every communication topic, a complete reversal from the 2006 survey.

Quantitative Communication

The results showed how far apart planners and clients are on their perceptions of what is being provided. Here are the results when both were asked if the following quantitative topics were part of their conversations:

Qualitative Communication

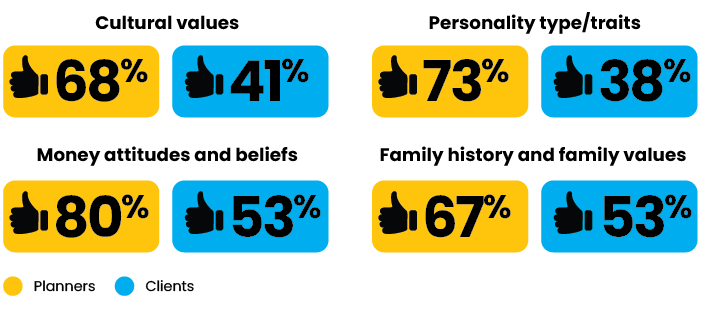

Planners and clients were also asked if the following qualitative topics/issues were addressed during their conversations:

In four key areas of qualitative data gathering, planners rated their effectiveness much higher than did their clients. Here’s how respondents finished statements starting, “Planner makes effort to learn about clients’…”:

More Work Needed

Based on the results, the researchers said more work needs to be done to understand why there was such a dramatic shift from 15 years ago. They were not sure if the planners were overconfident or clients had become more critical than they were in 2006.

The survey also found that clients want at least some virtual contact after the pandemic. More than half of clients (57%) said they prefer virtual meetings after the pandemic restrictions, whether exclusively or occasionally. Nearly eight in 10 advisors say they expect to use virtual meetings at least some of the time going forward.

Co-authors of the study were Anderson, president of the MQ Research & Education, and Deanna L. Sharpe, Ph.D., CFP, CRPS, CRPC, associate professor in the Personal Financial Planning Program at the University of Missouri. Contributing authors were Megan McCoy, Ph.D., AFC, LMFT, CFT-I, professor of practice and the director of the Personal Financial Planning Master’s Program at Kansas State University, and Derek Lawson, Ph.D., CFP, assistant professor in the Personal Financial Planning Program at Kansas State University and a financial planner at Priority Financial Partners in Durango, Colo.