The Internal Revenue Service’s audit rate has been lower this decade than in most taxpayers’ lifetimes, a New York Times analysis shows, and if the Trump administration follows through with plans to cut the agency’s workforce, audits will almost certainly become even rarer.

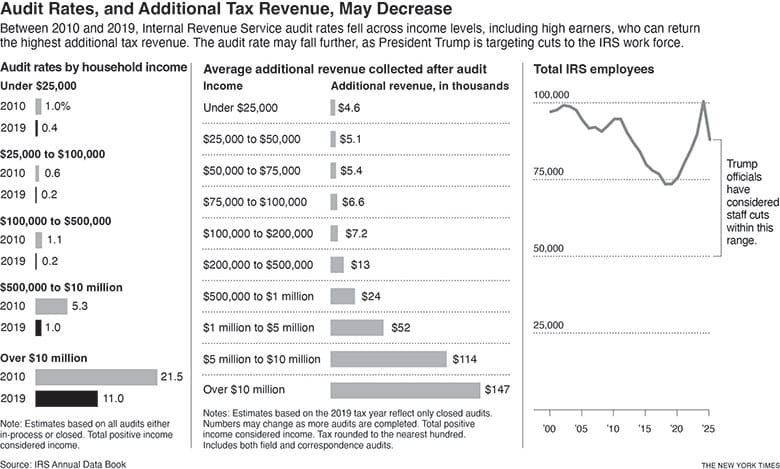

The most recent IRS data shows the audit rate of individual taxpayers has decreased by about two-thirds since 2010.

Exact comparisons of audit rates are challenging because the IRS has changed its definitions over time. But the Times analysis of historical IRS data found that the effective audit rates between 2020 and 2023, all under 0.5%, were lower than any published audit rate since at least 1950.

In 1980, the agency’s published audit rate was over 2%, and in 1960 it was over 3%.

In the 2010s, audit rates plunged for all income levels. For most Americans, an audit might have been a 1-in-100 event at the beginning of the decade. By the end of the decade, it was even less likely.

For households with very high incomes, the audit rate is also considerably lower than it used to be. (The IRS also audits corporations and partnerships, and its data shows steep declines in these audits, too.)

The lower audit rates have led to less revenue for the government. The agency collected about $11 billion of additional revenue through personal income audits of 2010 returns. More recent tax years have a significant percentage of audits still being processed, but additional revenue is trending downward. For the 2019 tax year, the agency has collected only about $4.5 billion from personal income audits so far.

The Trump administration is currently targeting a roughly 25% cut in the IRS workforce, according to people familiar with the matter, though they cautioned that the scale of potential cuts has continuously changed. The agency had about 100,000 employees in January, and cuts of between 18% and 50% have been discussed by the administration this year.

Bryan Camp, a professor at the Texas Tech School of Law who previously worked at the IRS, said a decrease in staffing would inevitably lead to fewer audits. He said the decline in audits over the last decade was primarily because of the loss of IRS workers; the agency cut its head count by about 20% from 2010 to 2020.

Congressional Republicans in the 2010s successfully cut appropriations for the IRS. President Joe Biden’s administration tried to reverse this trend as part of the Inflation Reduction Act of 2022. During Biden’s term, the IRS added about 20,000 employees.

The goal was to increase IRS enforcement spending by about $45 billion over 10 years in hopes of increasing revenue by about $125 billion over the same period.

It’s not clear if any increased revenues from the Biden plan will materialize. The Congressional Budget Office estimated at the time that it would take 30 months for the IRS to collect additional revenue from its new workers because of training time and the length of the average audit. By the time 30 months had elapsed, Trump was back in office. And congressional Republicans have since rescinded or frozen the extra IRS enforcement funding.

Trump Tax Feud

Trump has long feuded with officials over his own tax compliance. As a candidate in 2016, he said he had been under audit for years and believed it was “very unfair.” The Trump Organization was found guilty of tax fraud in 2022, and a New York Times investigation in 2018 found Trump participated in tax schemes in the 1990s that included instances of fraud.

The Trump administration laid off 7,000 IRS probationary employees this year, though their employment status is now subject to a court battle. The agency also lost 5,000 employees who opted to take a buyout offer. And several top IRS officials are said to be preparing to quit.

If the Trump administration were to cut IRS staffing levels by the more extreme 50%, former Biden Treasury official Natasha Sarin, now president of the Budget Lab at Yale, estimates a loss of $350 billion to $2.4 trillion in revenue over 10 years.

Although that estimate published by the lab covers a wide range, she said it was clear that funding the IRS pays for itself. “Every estimate has within it some sense that every dollar provided to the IRS generates X dollars over time,” she said. “Exactly how productive those dollars are is a subject of intense academic debate.”

Less revenue for the government would add to the deficit, even as Elon Musk, who is leading Trump’s cost-cutting efforts, says he is trying to narrow the deficit.

But Republicans say audits amount to harassment of taxpayers. Rep. Jason Smith of Missouri, chair of the tax-writing House Ways and Means committee, said in a statement shortly after Trump’s inauguration that the president’s approach with the IRS would help “middle-class Americans and small businesses living in fear” of more audits.

A White House spokesperson, Liz Huston, did not answer specific questions about IRS staffing levels or audit rates, but said in a statement: “President Trump has made it clear that he is committed to making the federal government more efficient without compromising mission-critical operations. There will be no disruptions to service.” The IRS did not respond to requests for comment.

Beyond IRS staffing levels, there are other reasons the audit rate has fallen since 2010, said David Hasen, a professor at the University of Florida’s law school. One of them is that Congress has moved many time-consuming administrative roles to the IRS.

“The IRS is asked to do more and more,” he said. “The Affordable Care Act involves the IRS. Other programs like the child tax credit do, too. It siphons off resources.”

Whom to Audit?

The Biden administration said its goal was to raise audit rates only on high-income earners, partnerships and corporations. The IRS commissioner at the time, Danny Werfel, promised the agency would ensure “audit rates do not increase for those earning less than $400,000 a year.”

Focusing audits on higher earners has political logic, but it also makes sense from a strict return-on-investment standpoint. An in-person audit of someone in the top 0.1% of earners takes twice as many auditor hours as an average in-person audit, but the potential additional tax revenue is many times greater.

Audits also have financial benefits for the government beyond the immediate tax collected, deterring taxpayers from skirting the rules in future years.

Ben Sprung-Keyser, an assistant professor at the University of Pennsylvania’s Wharton School, was part of a team of researchers who studied the long-term consequences of an audit. They found that taxpayers who were randomly audited and who owed additional money went on to pay more in future tax returns, even a decade later, compared with those who were not randomly audited.

In the ensuing years, “the result of those audits is approximately three times as large as the original revenue collected during the audit itself,” Sprung-Keyser said.

The deterrence effect is similar for low-income and high-income earners as a percentage of taxes paid, but the total dollars returned is much larger for high-income filers.

Monte Jackel, a tax lawyer who has represented companies and wealthy individuals, said that sophisticated taxpayers and their lawyers are aware of enforcement trends when they file their returns.

“You cannot take the audit rate into account in an opinion” for a client, Jackel said. “But realistically it’s always in the background.”

When there are fewer audits, he said, “word gets around.”

c.2025 The New York Times Company. This article originally appeared in The New York Times.