In the lead up to the Federal Reserve’s (Fed) September meeting, we’ve watched – with a degree of bewilderment – many market participants’ near obsession with the size of today’s rate cut. Whether 25 basis point (bps) or 50 bps, the data that guide monetary policy indicate that the time is now to step away from a restrictive stance.

More germane to investors is whether the Fed is behind the curve. Reducing rates into a resilient U.S. economy (the crowded soft-landing scenario) or cutting into a stalling economy marked by a rapidly cooling labor market (a hard landing) have very different ramifications for financial markets. Fed Chairman Jay Powell took great pains to frame today’s decision as what we would categorize as a bullish cut. Rather than a paradox, his rhetoric – peppered with words like balanced, confident and resilient – was aimed at signaling that the “strong” 50 bps reduction was not a cause for alarm, but a prudent initial step in normalizing policy.

When divining insight into how to position portfolios during this unique period of cutting rates when there are few signs of a struggling economy, our focus has been on how the Fed sees developments unfolding over the next year and how that will influence the terminal rate for this cycle.

The Luxury of Lower Inflation

We believe the Fed’s larger move was justified as it signaled that this wave of generational inflation is behind us. Perhaps defying expectations, the Fed was able to keep rates at 5.50% for an extended period because the U.S. labor market proved more impervious to higher rates than expected. While not setting off alarm bells, recent softening within the labor market, in the Fed’s own words, has caused it to shift to a more balanced approach toward its dual mandate. Given the past year’s progress on inflation, the Fed had the luxury to go big with this initial cut without unduly spooking the market.

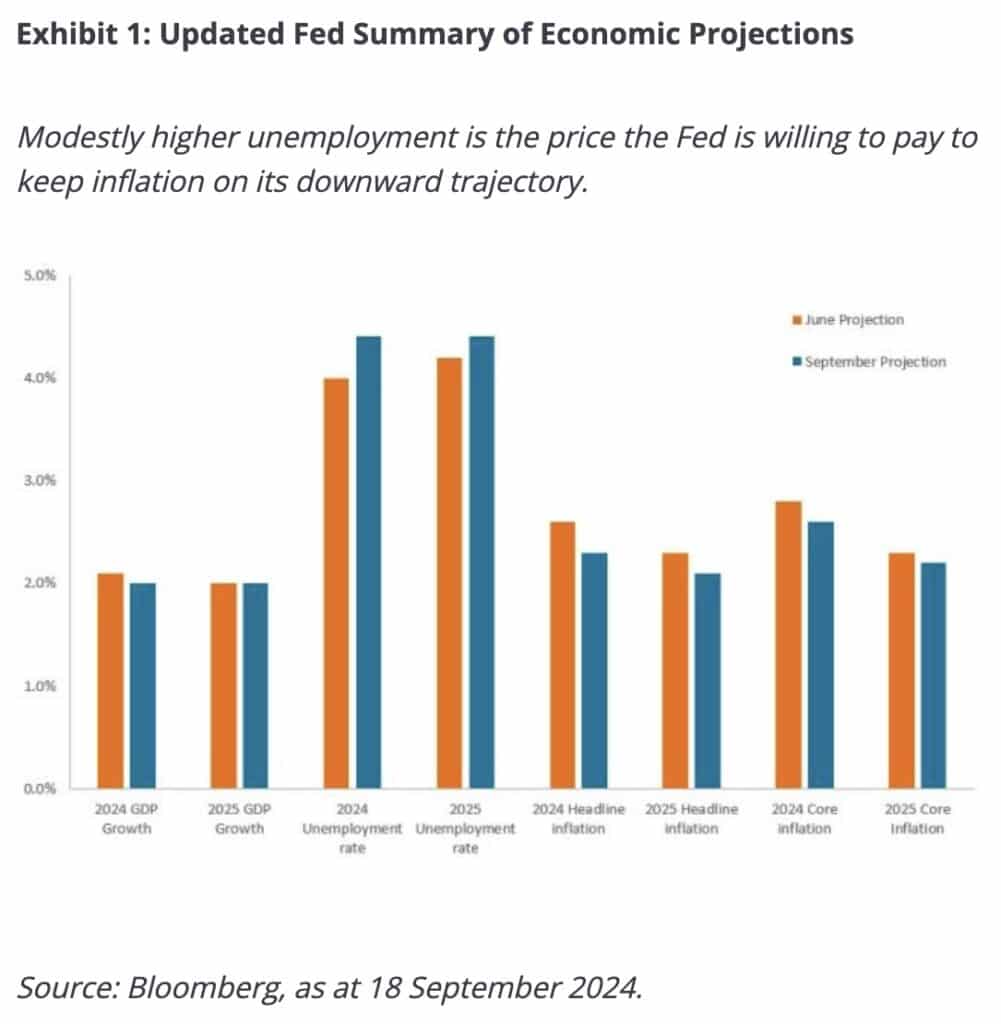

Data within the updated Summary of Economic Projections accompanying the meeting bear this out. Fed officials now see the unemployment rate finishing 2024 at 4.4% and remaining at the level through the end of next year. While still lower than levels that would be consistent with a material slowdown, the degree to which unemployment has risen has likely forced the Fed to be more vigilant with respect to potential downside surprises.

Although the increase in the unemployment rate has been largely driven by workers entering the labor force, some leading indicators of labor market health have grown wobblier. Job openings are 37% beneath their post-pandemic peak, inflation-adjusted wage growth, while still positive, has trended down and the four-week average of initial jobless claims – a proxy for a feared wave of layoffs – has risen from 201,000 to 231,000 thousand. As with the unemployment rate, this level remains well below what would be associated with economic contraction.

Modest softening in the labor market is likely the price the Fed is willing to pay for making progress on returning inflation to its 2.0% objective. For that matter, even with today’s cut, with core inflation at 2.6%, an upper rate limit of 5.0% is still restrictive. The Fed likely believes this level is sufficient to guide headline and core inflation toward its downwardly revised level of 2.1% and 2.2%, respectively, in 2025.

We believe it’s important to note that a 50 bps cut has not materially changed the Fed’s expectation of where the terminal rate for this cycle lies – still sitting between 2.5% and 3.0%.

The Cycle Lives On?

With the commencement of rate cuts behind us, the market can now focus on what type of landing will occur. Nailing a soft landing is notoriously difficult, and during the Fed’s historic stretch of rate hikes, the prevailing view was that this expansion would end – like most others – at the hands of overly restrictive policy. But over 2024, the pendulum has swung toward a soft-landing. After all, inflation fell without a spike in unemployment and U.S. consumer demand remains strong.

If the economy proved steady when facing a 5.5% policy rate, its resilience could now be buttressed by corporations and households benefiting from lower borrowing costs. The upshot is an extension of the economic cycle and a tailwind for riskier assets that have cyclical exposure or are faced with maturing debt over the midterm. Understanding the boost to the U.S. economy that a lower cost of capital would provide, the Fed, in our view, would have been more reticent to move 50 bps had it not been certain that wage-driven inflation on account of a red-hot labor market was less of a concern.

Some have interpreted the 50 bps move as evidence that the Fed may be behind the curve. Chairman Powell stated this was not the case, and the data seem to back up this claim. Still, one cannot entirely dismiss the risk that the long and variable lag of restrictive policy has yet to fully play out. In this hard-landing scenario, cutting rates would cease to be a luxury and instead become a lifeline seeking to stanch flagging investment and consumption. That cascading of events would mark the end of the post-pandemic expansion.

Taking What The Market Gives You – Namely Income and Diversification

From a positioning perspective, we do not see today’s move as a game changer for fixed-income investors. The known knowns haven’t changed. Inflation is cooling. The U.S. economy resilient. And the labor market, despite some softening, is nowhere near levels associated with recession. This belies an extension of the cycle that should be favorable for riskier assets, especially higher-quality corporate credits whose fortunes are more exposed to consumer strength. Similarly, companies with higher debt loads should benefit from lower borrowing costs.

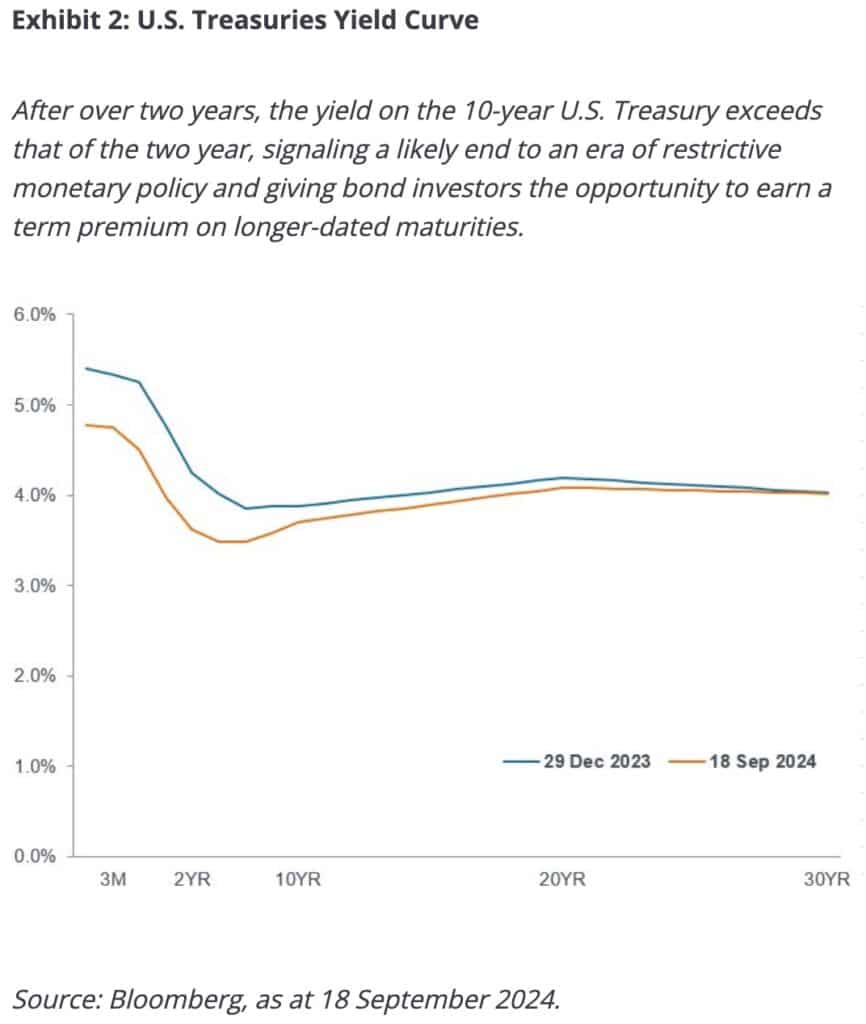

While these companies would be hurt in a hard landing scenario, a fixed income allocation can still aid a broader allocation by offering the potential to preserve capital and serve as a diversifier to riskier equities. In either scenario, the arrival of the rate-reduction cycle means that many points along the yield curve could deliver capital appreciation. In this respect, we believe duration is an investor’s friend. And at current levels, the yield curve still represents levels of income generation that have been a rarity during the past 15 years.

As the unknown unknowns are just that, investors should view an allocation toward higher-quality bonds with sufficient duration exposure as an integral component of a well-diversified portfolio, especially as the Fed seeks to stick the elusive soft landing.

IMPORTANT INFORMATION

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Jim Cielinski is Global Head of Fixed Income at Janus Henderson Investors, a position he has held since 2017. He oversees all of the global fixed income products and teams and leads Corporate Credit as well. Previously, Jim was the global head of fixed income for Columbia Threadneedle Investments from 2010. Prior to joining Columbia Threadneedle, he spent 12 years at Goldman Sachs Asset Management as managing director and head of credit. Before that, he was head of fixed income for Utah Retirement Systems, assistant manager of taxable fixed income for Brown Brothers Harriman & Co., and an equity portfolio manager for First Security Investment Management.

Daniel Siluk is Head of Global Short Duration & Liquidity and a portfolio manager at Janus Henderson Investors, a role he has held since 2024. From 2009, Daniel was portfolio manager at Kapstream Capital, a subsidiary of Janus Henderson Investors, which acquired Kapstream in 2015. Prior to this, he served as manager of investment analytics at Challenger, a position he held from 2007 to 2009. While there, he provided attribution and risk metrics for the firm’s internal funds management business as well as their boutique partnerships, which included Kapstream. Before Challenger, he spent four years in London, where he implemented and tested attribution and risk systems for Insight Investment, the funds management arm of Halifax Bank of Scotland, and Northern Trust.