Meeting outside Paris last week, top officials from France, Germany and Italy pledged to pursue a coordinated economic policy to counter stepped-up efforts by Washington and Beijing to protect their own homegrown businesses.

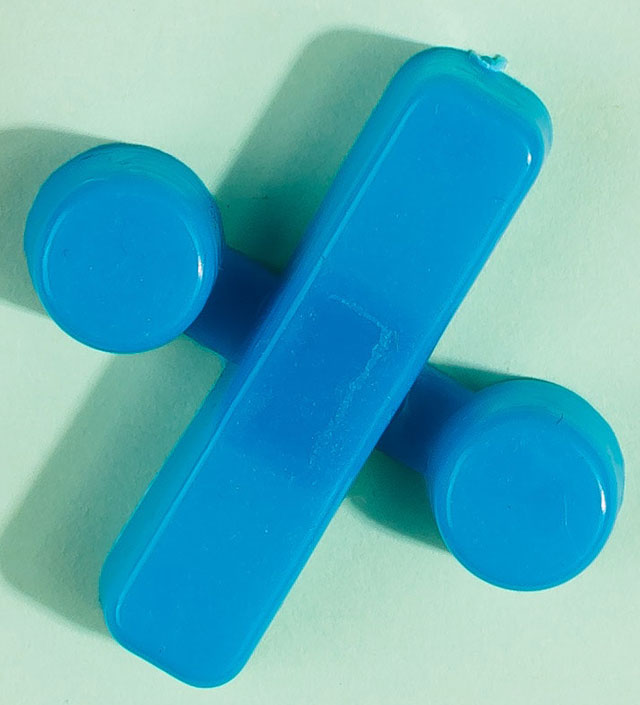

The three European countries have joined the parade of others that are enthusiastically embracing industrial policies — the catchall term for a variety of measures like targeted subsidies, tax incentives, regulations and trade restrictions — meant to steer an economy.

More than 2,500 industrial policies were introduced last year, roughly three times the number in 2019, according to a new study. And most were imposed by the richest, most advanced economies — many of which could previously be counted on to criticize such tactics.

The measures are generally popular at home, but the trend is worrying some international leaders and economists who warn that such top-down economic interventions could end up slowing worldwide growth.

The sharpened debate is sure to be on display at the economic lollapalooza that opens Wednesday, April 24 in Washington — otherwise known as the annual spring meetings of the International Monetary Fund and the World Bank.

“There are different ways of shooting yourself in the foot,” M. Ayhan Kose, the deputy chief economist of the World Bank, said about the trend of rich countries pursuing industrial policies. “This is one way of doing it.”

And in a speech the previous week, Kristalina Georgieva, the IMF’s managing director, cautioned that except in extraordinary circumstances, the case for government intervention was weak.

Whether and how ardently governments should try to control their economies has been vigorously debated since the Industrial Revolution. The current wave of policies, though, is a stark contrast to the classic open markets, hands-off government ideology championed by the citadels of capitalism in recent decades.

That faith in the superiority of free-market policies was deeply shaken in recent years by a string of global jolts — the pandemic, supply chain meltdowns, soaring inflation and interest rates, Russia’s invasion of Ukraine, and rising tensions between the U.S. and China.

In many capitals, security, resilience and self-sufficiency were pushed to the front of the list of economic policy goals along with growth and efficiency.

After years of complaints about China’s subsidies of private and state-owned industries, the U.S. and Europe have increasingly copied Beijing’s playbook, undertaking multibillion-dollar industrial policies focused on critical technology and climate change.

The U.S. passed two mammoth bills in 2022 to strengthen its domestic semiconductor industry and renewable energy sector. Europe passed its own Green Deal Industrial Plan last year to speed the energy transition. Soon after, South Korea approved the K-Chips Act to support its semiconductor production.

“A few years ago, when I was starting out as finance minister, you couldn’t pronounce the words ‘European economic policy’ or ‘European industrial policy,’” Bruno Le Maire, France’s finance minister, said last week after the ministers’ meeting.

Positive appraisals of the approach have grown in recent years. One overview of the subject by a team that included Dani Rodrik, a Harvard economist, found that the “recent crop of papers offers in general a more positive take on industrial policy,” compared with the traditional “knee-jerk opposition from economists.”

Joseph E. Stiglitz, a Nobel Prize-winning professor at Columbia University, has called industrial policy a “no-brainer.”

But many economists including Kose of the World Bank remain skeptics, arguing that most industrial policies will end up reducing overall growth, making things worse rather than better.

In response to the latest wave of interventions, the IMF has drawn up a new set of guidelines for when and how industrial policies should be carried out.

There are gains, if they are done right and used to address an extraordinary market failure, like the dangers posed by climate change, the IMF says. That means clearly identifying the social benefits like limiting greenhouse gases, broadly sharing innovations across borders and refraining from discriminating against foreign firms.

But much of the analysis has been devoted to how easy it is to get things wrong, by misallocating or wasting money, giving powerful business interests too much sway over government decisions or setting off a tit-for-tat trade war.

“What stands out about this current resurgence is that there is a reliance on costly subsidies,” said Era Dabla-Norris, an author of the analysis. And these are often “combined with other types of discriminatory measures against foreign firms.”

When protectionist measures distort global trade and investment flows, she said, “the global economy loses out.”

Governments meddle in markets for all kinds of reasons — to prevent job losses, spur investments into a particular sector or freeze out a geopolitical rival.

Of the 2,500 interventions introduced last year, protecting domestic industries accounted for the largest chunk, followed by combating climate change or shoring up supply chains, according to a study done in conjunction with the IMF. Measures that cited national security as the motivation made up the smallest share.

The data also suggested that when a country introduced a subsidy, there was roughly a 75% chance that within a year, another country would introduce a similar one on the same product.

As fears about Europe’s ability to compete with the U.S. and China increase, the European Union seems determined to move ahead with more coordinated economic interventions — even though its members do not necessarily agree on which ones.

France has proposed the most aggressive measures, including a provision to reserve half of public spending from industrial policy on European-made products and services, while Germany has been more skeptical of Buy Europe approaches.

But there is support across the board for increasing funding, slashing cumbersome regulations and promoting a single market for investments and savings.

In February, the European Parliament agreed to increase its own green industrial capacity, and in March, the bloc adopted regulations to secure its supply of essential raw materials and bolster local production. Members also proposed for the first time a joint defense industrial strategy.

(STORY CAN END HERE. OPTIONAL MATERIAL FOLLOWS.)

The French, German and Italian economic ministers have been gathering to develop policies to stimulate green and digital technologies before EU leaders meet this year to adopt a new five-year strategic plan.

Now that “the term ‘industrial policy’ is no longer taboo,” Le Maire said, “Europe needs to show its teeth, and show that it’s determined to defend its industry.”

c.2024 The New York Times Company. This article originally appeared in The New York Times.