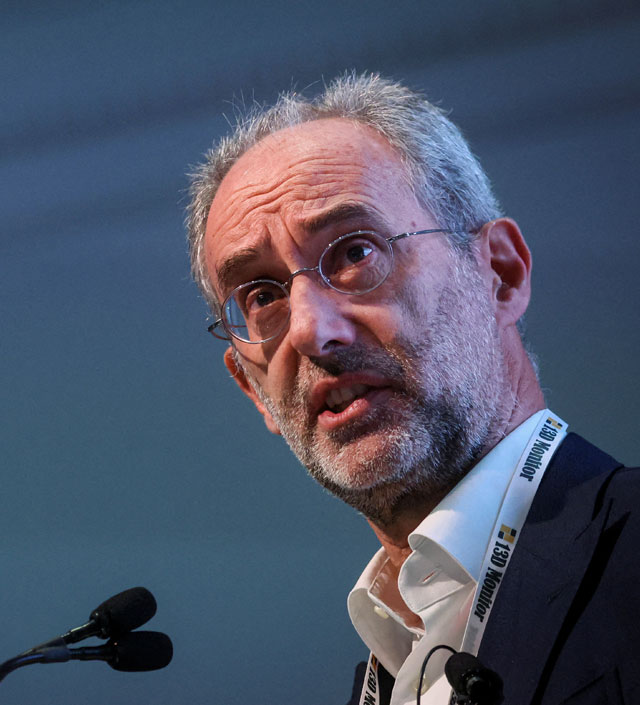

BlackRock CEO Laurence Fink’s total pay for 2023 was $26.9 million, down from $32.7 million a year earlier, according to the company’s regulatory filings.

BlackRock, the world’s largest asset manager, which managed $10 trillion in assets as of Dec. 31, 2023 and served clients in over 100 countries across the globe, was founded by Fink in 1988.

Fink is under scrutiny as London-based activist investor Bluebell Capital Partners proposed an amendment to the company bylaws to require the chairman be an independent director.

BlackRock’s board has recommended shareholders to vote against the proposal.

Bluebell’s latest activism comes 15 months after it first took aim at the New York-based asset manager. The investor wanted to replace CEO Fink and criticized the company as being inconsistent in its focus on environmental, social and corporate governance (ESG) issues.

Over the years, Fink has drawn ire from several policymakers over BlackRock’s corporate governance practices. The company said last year it lost around $4 billion in assets under management as a result of the political backlash.

Fink’s compensation package for 2023 included a base salary of $1.5 million, a bonus of $7.9 million, stock awards of $16.4 million and other compensation of $1.09 million, according to the company’s filings with the SEC.

His reduced pay sharply contrasts that of several Wall Street chiefs, including top bosses of Goldman Sachs, JPMorgan, Citigroup and Morgan Stanley, with all of them receiving raises in 2023.

Bank of America’s CEO Brian Moynihan, however, took home a reduced pay after the bank’s annual profit fell 4%.

BlackRock’s profit was 6% higher and saw assets under management jump 16% in 2023 from a year earlier.

This article was provided by Reuters.