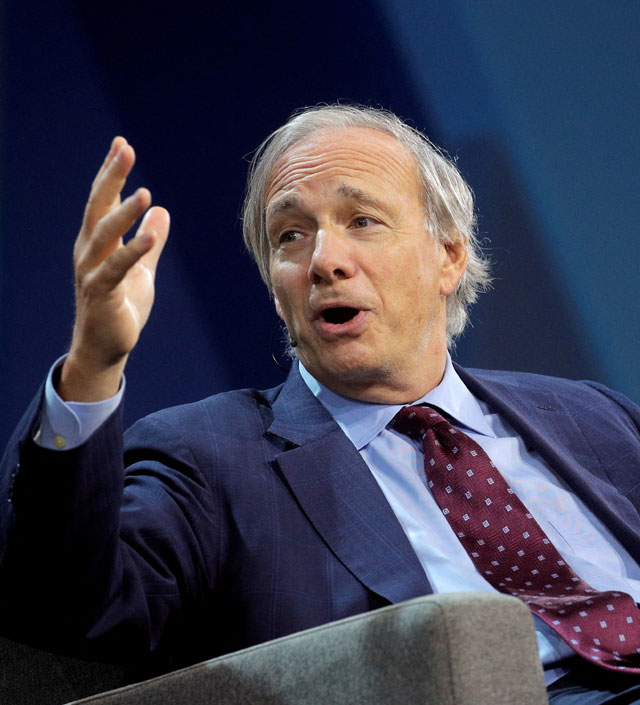

Billionaire Ray Dalio, founder of one of the world’s biggest hedge funds, has predicted a sharp plunge in stock markets as the U.S. Federal Reserve raises interest rates aggressively to tame inflation.

“I estimate that a rise in rates from where they are to about 4.5 percent will produce about a 20 percent negative impact on equity prices,” Bridgewater Associates’ founder Dalio wrote in a LinkedIn post on Tuesday.

His comments came the day data showed U.S. consumer prices unexpectedly rose in August. The inflation data raised fears of another outsized interest rate hike next week and sent stock markets into a downward spiral.

“…interest rates will go up … other markets will go down … the economy will be weaker than expected,” Dalio wrote.

“This will bring private sector credit growth down, which will bring private sector spending and, hence, the economy down with it.”

Ignites concerns about stocks

Dalio’s bearish view further ignites concerns about valuations in U.S. stocks.

While the S&P 500 index’s forward price-to-earnings multiple is far below what it commanded at the start of the year, investors believe stock valuations may have to fall further to reflect the risks of rising bond yields and a looming recession.

Rising mortgage rates are already weighing on the housing sector as the average interest rate on the most popular U.S. home loan rose above 6% for the first time since 2008.

A significant economic contraction will be required, but it will take a while to happen because cash levels and wealth levels are now relatively high, Dalio wrote.

“We are now seeing that happen. For example, while we are seeing a significant weakening in the interest rate and debt-dependent sectors like housing, we are still seeing relatively strong consumption spending and employment.”

This article was provided by Reuters.