Fifth Wall, a Los Angeles-based venture capital firm focused on real estate technology, said on Thursday it has raised $500 million for a climate fund to help decarbonize an industry estimated to account for nearly 40% of the world’s carbon emissions.

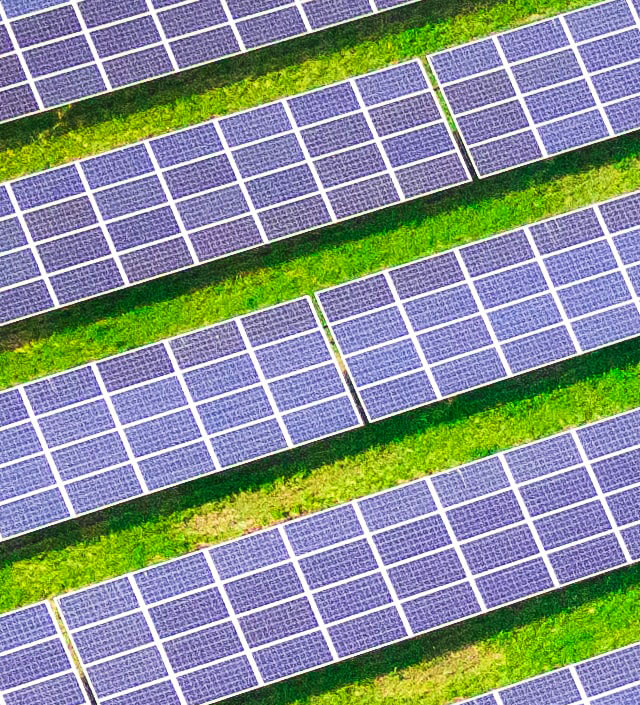

The fund, which brings together some of the largest owners and operators of real estate globally, will invest in software, hardware, renewable energy, energy storage, smart buildings and carbon sequestration technologies.

While real estate emits about two-fifths of total global greenhouse gases during a building’s life cycle, according to brokerage JLL, estimates show the industry has invested only $94.6 million into climate technology R&D over the past 10 years, Fifth Wall said.

The cost to retrofit existing U.S. commercial buildings to decarbonize the infrastructure on which they run is estimated at $18 trillion, said Brendan Wallace, co-founder and managing partner at Fifth Wall.

“This is really the first time the industry, acting collectively, has come together to invest in this critical tech to help decarbonize real estate,” he said. “Real estate is the single-biggest lever we can turn on to mitigate climate change.”

Strategic Investments

Fifth Wall has received commitments from American Homes 4 Rent, Spanish bank Banco Bilbao Vizcaya Argentaria, British Land Co PLC, CBRE Group Inc, Brazil’s Cosan SA and the New Zealand Superannuation Fund, a sovereign wealth fund, among many others.

The Climate Fund has already completed strategic investments in several companies, including Assembly OSM, Brimstone, Clarity AI, Electric Hydrogen, ICON, Sealed, SPAN, Turntide Technologies and Wildcat Discovery Technologies, Fifth Wall said.

The climate fund will bring Fifth Wall’s capital under management to about $3.2 billion.

“The real estate industry is the single-most contributed industry to climate change,” Wallace said. “It’s the culprit that was hiding in plain sight.”

This article was provided by Reuters.