The number of U.S. workers age 60-plus has exploded over the past 20 years and advisors should take note.

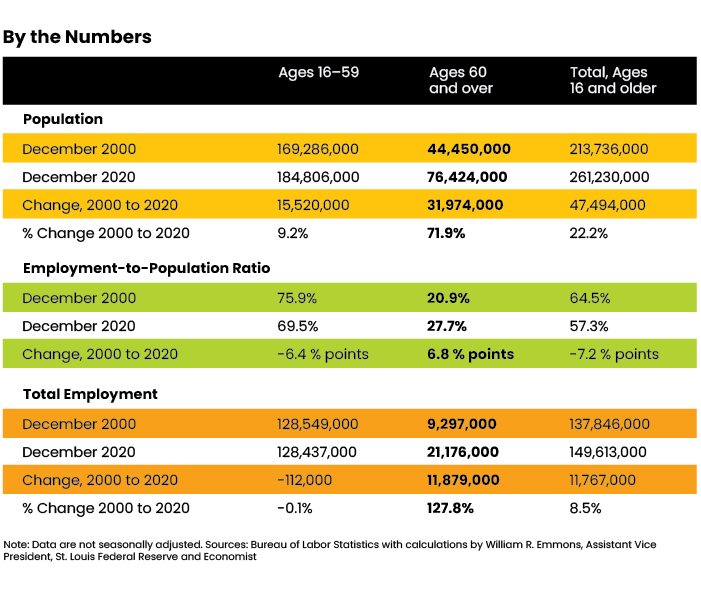

According to a statistical analysis released by the Federal Reserve Bank of St. Louis, all of the 11,767,000 jobs the U.S. economy added in the 20 years ending on Dec. 31, 2020, can be attributed to an increase in workers age 60 and older. Over the same period, the number of employed people between the age of 16 and 59 decreased by 112,000 people.

In percentage terms, the proportion of employed people in the younger population group dropped from 75.9% in December 2000 to 69.5% in December 2020; a decrease of 6.4 percentage points. Meanwhile, those in the 60-plus group saw their employment rate increase by 6.8 percentage points from 20.9% to 27.7% over the same time period.

Another factor noted in the Fed analysis is the relative size of the two population groups. During the time period included in the study, the population size of the 16- to 59-year-old group increased by 15,520,000, or 9%, while the population of those 60 and older increased by 31,974,000, or 72%. Thus, even if the rate of employment had remained the same in both groups, the percentage of jobs held by older workers would still have increased.

Combining both factors, total employment in the older group grew by 127.8% over the two-decade time period, while in the younger cohort, employment shrank by 0.1%, according to the Fed.

According to William R. Emmons, an assistant vice president and economist at the St. Louis Fed, the analysis suggests that older workers will continue to command an increasing share of the employment market, as “continued population aging is almost certain, and signs point toward further increases in the earnings-to-population (E-P) ratio among older adults.”

“The greatest source of uncertainty about the age composition of the future workforce,” he added, “is the direction of change of the E-P ratio among working-age people under 60.

The numbers used by the Fed for the analysis were not seasonally adjusted, nor do they consider reasons why a person may or may not be employed. Thus, they are not directly comparable to unemployment statistics that may, for example, discount those not actively looking for work, or those who may be underemployed. They are based only on the number of people working, and the total number of people in the relevant age group.