Although the COVID-19 pandemic and ensuing recession have made the past year one of the most difficult for most Americans, their generosity has never been stronger.

Schwab Charitable, one of the nation’s largest providers of donor-advised funds and other philanthropic services, reports its donors created record impact in 2020 by supporting nearly 100,000 charities through 830,000 grants totaling $3.7 billion. Compared with 2019, dollars granted rose 35% and the number of grants climbed 39%.

Year over year, donors recommended grants to 13% more charities and 74% of donors supported at least one new charity in addition to charities they previously supported.

“Everyone stepped up but I would say that the baby boomers and the Greatest Generation stepped up in the biggest way,” Kim Laughton, president of Schwab Charitable tells me. “They were the ones that really, really pushed the needle, I think, and drove a lot of that 35% to 39% increase in giving.”

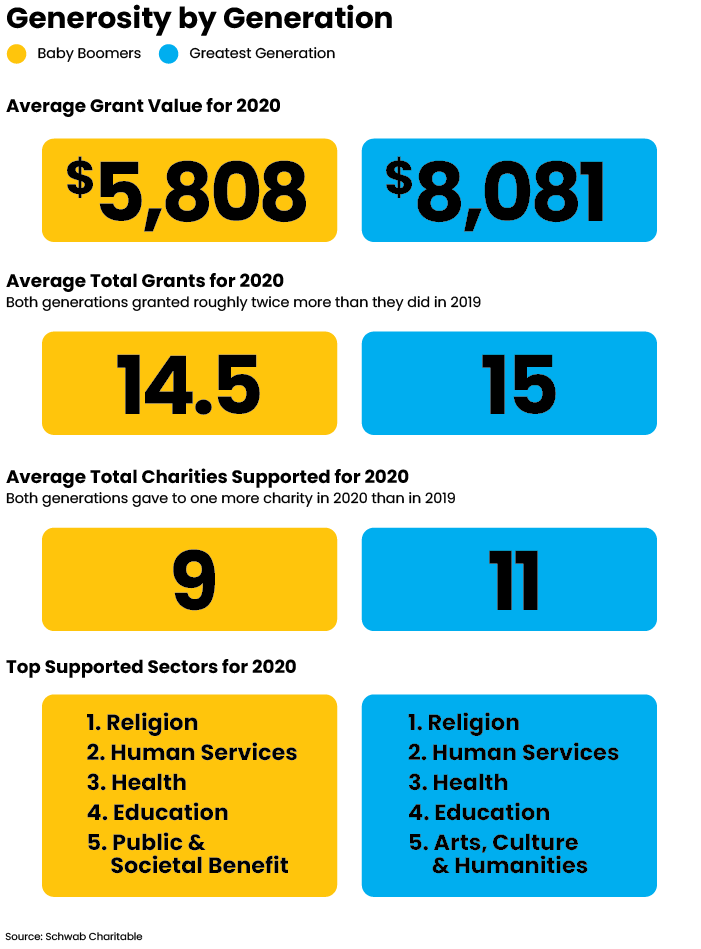

According to Schwab Charitable, which recently did a generational analysis for Rethinking65, the average grant value for calendar year 2020 was $5,808 for boomers and $8,081 for the Greatest Generation. Compared with 2019, members of each group, on average, made two more grants in 2020 (boomers, 14.5; Greatest Generation, 15) and donated to one more charity (Boomers, 9; Greatest Generation, 11).

Both generations supported the same top four sectors in 2020: Religion, human services, health and education.

Not Just a Sideshow

Having a charitable giving goal or a vehicle — whether a private foundation or a donor- advised fund — is an important way for people to make charitable giving a bigger part of their lives right now, says Laughton. It helps a lot to integrate charitable giving into clients’ financial plans instead of “having it be a sideshow where they have to think about it separately,” she says. Schwab Charitable has received a lot of feedback from donors who say they like that they can do everything in one place, she notes.

“The other thing we’ve heard, especially from the older generations — and they’re the ones that are more likely to have children, maybe adult children and grandchildren,” she says, is that “trying to involve the younger generations with their giving is a really fruitful, impactful initiative.”

Baby boomers are “at that sort of sweet spot where they’re still young enough to be active in their philanthropy but old enough to be thinking about what’s next,” she says.

According to the National Center for Family Philanthropy, families have dramatically changed the causes they want to support in the wake of COVID-19 and the media focus on racial injustice, partisan tensions and economic challenges. NCFP’s report “The Giving Landscape: 2020 Trends” says families are having multi-generational conversations that are leading them to reconsider why they give and their strategies for achieving the social impact they desire.

Virtual Granting

Meanwhile, more families — including Laughton’s — are opting for virtual charitable-giving discussions during this era of social distancing.

After hearing about other families doing this, she suggested this idea to her mom as a way to connect their geographically disbursed family over the holidays. Her mom was game, so three generations of their family — in their 80s down to their early teens — engaged in charitable giving during a two-hour Zoom call.

Before the call, family members were asked to come prepared to discuss a charity of interest. “They all took it seriously,” says Laughton. “I don’t think anyone wanted to look like the one that wasn’t prepared.”

People can learn more about charities through many resources, including Candid (formerly GuideStar), Charity Navigator, Charity Watch, Give.org and Center for Disaster Philanthropy, says Laughton, who doesn’t promote one resource over another.

Laughton’s mother decided to set aside a certain amount of money from her charitable account for each child and grandchild. During the call, everyone took turns presenting charities they wanted to support, explained why, and answered questions.

Some wanted to support specific missions in their local communities around the country and talked about the impact. The younger people were more interested in environmental and social justice issues and spoke passionately about them, says Laughton.

In general, “You end up finding that a lot of people start supporting each other’s charities that they never knew about before,” says Laughton. “It’s a great way for the younger generation to teach the older and vice versa.”

During the Zoom call, her mother wrote down all the charities and then made grants in honor of the family member who nominated each grant. “It was a great, great family bonding experience,” says Laughton, “so I think we’re going to make that an annual event, even after COVID.” It’s a good idea to pick a moderator for family charitable-giving calls so everyone doesn’t talk over each other, she adds.

Laughton notes that families aren’t the only ones tuning into charitable giving. According to the 2020 Schwab Benchmarking Survey, 84% of advisors offer charitable planning services, up from 68% in 2015.

“If you’re not willing to talk to clients about this and offer this, then someone else is,” she says. “It’s not really one of those things you can decide not to do anymore.”

Jerilyn Klein is editorial director of Rethinking65.