Seven years ago, I wrote an essay about what life would feel like if I didn’t struggle with saving money. In it, I envisioned the power of having enough in emergency funds to tide me over in case I needed to leave an abusive job or relationship.

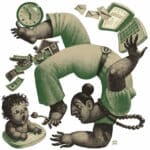

But writing that essay and having it go viral failed to change the struggle I had with my own bank account. In building my financial house, I continued my fractured existence as its construction worker, arsonist and firefighter.

Around the same time, I began to suspect I had attention deficit hyperactivity disorder, or ADHD, after I saw more and more people posting about it on Instagram. But because I thought having ADHD simply meant I was distractible, and because a 90-minute evaluation cost $260, I waited to get a diagnosis.

In 2021, when I was 39, my frustration pushed me to cobble together the money for a test. My diagnosis handed me a map to the mental landscape I’d wandered lost in for four decades.

According to the Centers for Disease Control and Prevention, boys are more likely to be diagnosed with ADHD than girls during childhood, because boys more often display the well-known hyperactivity trait. But more women, who tend to display the lesser-known inattentive trait, are being diagnosed later in life, thanks in part to ADHD groups and content creators who have helped them recognize that they have symptoms of the neurodevelopmental disorder. From 2020 to 2022, the incidence of ADHD diagnosis in women between ages 23 and 49 almost doubled.

For many of us, the dots connected straight from our diagnosis to our checking account. As one person in a Facebook group called Neurodivergent Finance/ADHD Finance put it, “You folks get the panic.”

A TikTok Following

The pandemic increased ADHD awareness, said Dr. Sasha Hamdani, a psychiatrist and ADHD clinical specialist, because “people were removed from previous architecture that gave them structure and stability.”

During lockdown, one of Hamdani’s patients showed her a TikTok video of a 12-year-old who delivered a medically unsound theory that people who sneeze multiple times in a row are more likely to have ADHD.

That showed Hamdani, who has the disorder, that these platforms could be flooded with misinformation. So she decided to make a series of bite-size educational videos that she assumed would be just for her own patients to reference.

I’m now part of her large social media following, consuming content that aligns with her book “Self-Care for People With ADHD.” Her explanatory TikTok videos, among those of other creators, have served as a kind of currency between myself and those close to me with ADHD. We message each other videos that give language to our experience. Sometimes we’re shocked to realize that the cause of certain struggles — like my chicken-scratch handwriting — is part of our having ADHD. I’ve used the videos to explain my behavior and perspective to my friends and family.

Hamdani said money issues, more than other common aspects of ADHD — such as chronic lateness, interrupting or sensitivity to rejection — pushed people to seek care.

“ADHD, intrinsically, is a failure of numerous regulation checkpoints,” she said. “You can have money management issues from lots of different places.”

A lack of impulse control, she said, leads to impulse spending, and difficulty with executive functioning and planning makes budgeting a struggle. Issues with emotional regulation, she added, can lead to spending as a coping mechanism.

In testing an app she developed for managing ADHD, Hamdani noticed an additional challenge for women.

“I have found such a clear correlation with my impulsivity and my cycles,” she said. Estrogen dips on premenstrual days, she explained, and because estrogen and dopamine typically work together, low estrogen means low dopamine, causing her to be more impulsive. “I cross-correlated it with my credit card statements, and there’s a $600 bump in those days,” she said.

Scratching the Dopamine Itch

“Dopamine’s the magic molecule,” said Dr. Edward M. Hallowell, a board-certified psychiatrist and founder of the Hallowell ADHD Centers, where I was diagnosed. Dopamine, a neurotransmitter, plays a role in attention and mood and is, as he calls it, the great mediator of pleasure. “When you access it properly, it gives you pleasure, and when you access it improperly, you become an addict,” he said. “It’s a very powerful little molecule, and people do all kinds of things in search of their dopamine hit.”

People with ADHD need more stimulation to feel the ordinary pleasure that most people feel, he said, which often means they resort to more extraordinary means to get it.

“Ordinary life just doesn’t do it for us,” said Hallowell, who also has ADHD. “Whereas someone else wouldn’t need the extra boost of dopamine to feel good about being alive, we do. And I call that the itch at the core of ADHD. That’s absolutely crucial — because how you scratch it makes all the difference in the world.”

This itch is sometimes referred to as reward deficiency syndrome. Spending is one way to scratch the itch, and the more expensive something is, he said, the more exciting it is.

Hallowell described ADHD as a medical problem that could be treated with medication and certain strategies. He recommends focusing on the positives of ADHD, such as curiosity, creativity, and energy, and getting a coach to help with the challenges.

“I can no more manage finance than I can build an automobile,” he said, admitting even he still feels a degree of shame that he hasn’t controlled his money habits as much as he would have liked. His wife manages his finances. “We are notoriously bad in handling money.”

Overcoming the ADHD Tax

After racking up $15,000 in impulse spending debt, Ellyce Fulmore hit a breaking point during the pandemic, when losing her routine exacerbated her inability to focus. She also spent quite a bit of time on TikTok, where she learned about the ways that symptoms of ADHD, such as inattentiveness, can show up in women. She was diagnosed with the disorder in December 2020.

Fulmore, an ADHD finance educator and author of the forthcoming book “Keeping Finance Personal,” said one of the main challenges for people with the condition is what’s referred to as the ADHD tax: the extra costs that people incur because of its symptoms.

ADHD doesn’t always cause people to spend. I know multiple people in personal finance whose ADHD causes them to fixate on money, some to the point of struggling to spend.

But because activities like planning or budgeting don’t usually give people with ADHD a dopamine hit, they can find it harder than neurotypical people to get started or stick to accounting activities. This results in extra costs — paying cancellation fees for missed appointments, late fees for not opening a bill on time, or losing refunds because we missed the deadline for returning an unwanted purchase.

Fulmore offers an ADHD money management program that incorporates whatever makes it exciting, novel, or interesting to follow the dopamine road to financial success.

She used sticker charts, colored progress trackers, and bullet journaling to “hack the system” of her brain. She also automated her savings and debt payments.

“For me, what has helped has been unlearning a lot of the neurotypical expectations,” she said. “I’m going to approach things differently, and it’s not going to be the way that traditional personal finance education tells you to do something.”

Fulmore started therapy to deal with the shame she had accumulated from a world that reflected a message that her struggles were her fault. She also started the stimulant medication Vyvanse, which helped her focus and reduce her spending. Aside from her student loans, she’s now free of debt.

A Satisfying Diagnosis

Madison Kemp’s husband, who was diagnosed with ADHD in elementary school, forwarded her a TikTok video showing a stack of boxes on a porch and a reference to “dopamine purchases” arriving all at once. “You do this all the time,” she said he had told her.

Kemp, 33, always felt she was chasing her financial tail: as soon as she resisted spending, she’d reward herself with more spending. She played what she calls “rent chicken,” hoping a rent check wouldn’t get cashed until after payday.

She found her diagnosis satisfying. “Until I was diagnosed, I was like: ‘Everyone has to go through life like this, right?’ ” she said.

Now that she’s on the non-stimulant ADHD medication Strattera, she can wait a full day to consider a purchase, and she finally feels ready to take on home buying.

She follows ADHD TikTok accounts like Catiosaurus, finding relatable examples of habits she has had her entire life.

“It’s like, ‘Oh, there are people who also do it like that, for that reason,’ and you really just feel like there’s actually a community,” she said.

Breaking the Shame Cycle

Shannon D. Smith had neglected her money journal. When she finally tallied her expenses, she realized why money felt tight the last month — her family had spent $700 dining out.

“And I cried,” Smith said. “I felt irresponsible. I felt like a bad mom. I kept thinking: I should know better.”

Her inability to focus at work made her worry it might be the onset of Alzheimer’s, a disease that runs in her family. But she found that when she was working on her own business, she could focus into the night. Her doctor recognized features of ADHD.

Smith’s ADHD diagnosis last year, at age 42, helped explain her struggles with delaying gratification.

She also internalized the stereotype that women are bad with money.

“You have that deep-seated belief that you’re not capable of handling money, and then you have that belief kind of be a self-fulfilling prophecy,” Smith said.

Her diagnosis helped her seek support for herself and her children, all of whom she suspects have ADHD, as research has shown it’s hereditary. “If I had this information when I was younger, I could have been so much further along,” she said.

Smith, who coaches other women, tries to think of ADHD as less a limitation than as a guide. She reads ADDitude, a quarterly publication focused on ADHD, and follows the podcast Attention Different. She automates savings, uses accountability partners and gives herself a 24-hour rule for spending.

“I’m in a number of support groups, and hearing so many other women share the same stories of struggling with money or struggling with impulsivity or self-control, it was just validating to feel like, OK, well, I’m not the only one,” she said. “So maybe I’m not as bad a person as I thought I was.”

c.2023 The New York Times Company. This article originally appeared in The New York Times.